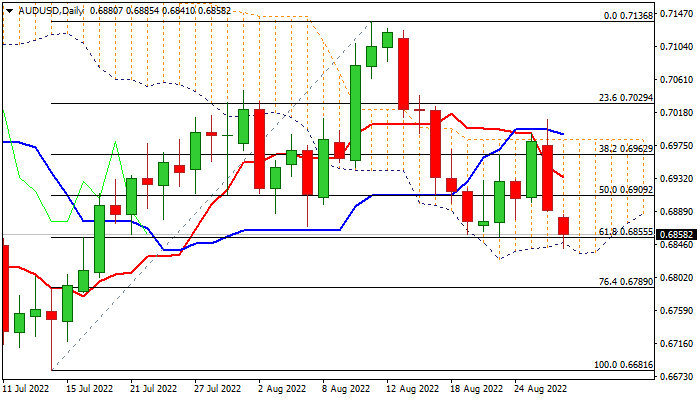

Bears remain fully in play but face headwinds from key support zone

The Aussie dollar started the week in negative mode, opening with gap lower after hawkish comments from Fed chair Powell further boosted the US dollar and extending last Friday’s 1.2% drop.

Fresh bears cracked key supports at 0.6850 zone (daily cloud base / Fibo 61.8% of 0.6681/0.7136 upleg / higher base, but face strong headwinds here and so far unable to break lower, despite firmly bearish technical studies on daily chart, as significantly better than expected Australian July retail sales also contributed to reducing pace of fresh bears.

The price may hold in extended consolidation while 0.6850 pivots hold, with l upticks (under 0.6915, converged 10/55DMA’s) to offer better selling opportunities, for firm break of 0.6850 zone that would generate strong signal of bearish continuation.

Res: 0.6885; 0.6915; 0.6957; 0.6982

Sup: 0.6841; 0.6802; 0.6789; 0.6719