Bears run out of steam at key support

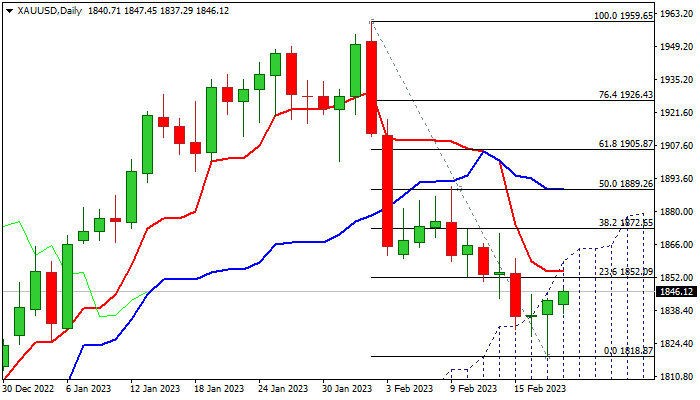

Gold remains constructive on Monday after larger bears failed to register a clear break of pivotal Fibo support at $1827 (38.2% of $1614/$1959) last Friday, leaving daily hammer candlestick (initial signal of reversal) and a bear-trap under Fibo support, which reinforces bullish signal.

Fresh recovery sees break and close above $1854 (converged 10/55DMA’s), as a minimum requirement to validate initial bullish signal, though more upside action (extension and close above daily cloud top ($1864) will be needed to confirm signal and expose upper pivot at $1890 (daily Kijun-sen / 50% retracement of $1959/$1818 fall / Feb 9 high).

On the other hand, larger picture is predominantly bearish, suggesting that limited correction ahead of fresh weakness, would be likely near-term scenario.

The downside is expected to remain vulnerable as long as the price action remains within daily cloud and capped by cloud top that would keep the scope for renewed attack at $1827 pivot, loss of which would open way towards $1900/$1776 (psychological / 200DMA).

Res: 1854; 1864; 1872; 1890

Sup: 1837; 1827; 1818; 1800