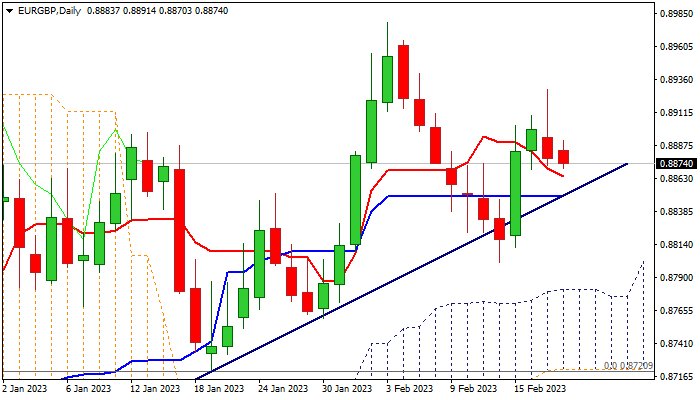

Near-term structure weakens but the price is still holding above initial support

The cross remains at the back foot on the first day of the week, after strong upside rejection left bearish daily candle with long upper shadow, signaling recovery stall and increasing pressure.

Fresh bears pressure pivotal support at 0.8864 (daily Tenkan-sen / 50% retracement of 0.8800/0.8928 upleg) with firm break here to confirm negative signal risk attack at next key support at 0.8850 (daily Kijun-sen / Fibo 61.8% / bull-trendline drawn off 0.8560 low).

Fading bullish momentum on daily chart and south-heading stochastic weigh on near-term action, though countered with daily Tenkan / Kijun-sen, still in bullish setup.

Ability to hold above daily Tenkan-sen will signal that bulls remain in play and look for fresh push higher after correction, while close below daily Kijun-sen would sideline bulls and open way for test of key near-term support at 0.8800 (Feb 14 low).

Res: 0.8898; 0.8928; 0.8940; 0.8978

Sup: 0.8864; 0.8850; 0.8830; 0.8800