Better than feared us labor data inflate dollar

Dollar rose across the board after US jobs data showed better than markets feared results in April.

Non-farm payrolls and unemployment came below horrific forecasts (which showed expectations for the worst situation in jobs sector since Great Depression) and average earnings well overshot consensus.

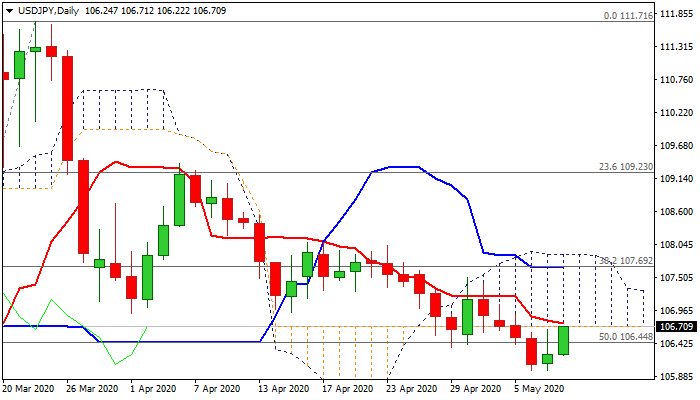

The USDJPY pair jumped from new seven-week lows at 105.98 (6/7 May lows) and is currently testing strong barrier at 106.70 (daily cloud base / 10DMA).

Firm break above 106.70 pivot would put larger bears (bear-leg from 24 Mar high at 111.71) for stronger recovery, as bears were rejected twice (Thu/Wed) at 105.98.

Adding to positive signals would be strong bullish close today that will start forming reversal pattern and also signal formation of bear-trap on weekly chart.

Recovery extension into daily cloud would face obstacles at 107.15 (20DMA), 107.51 (30DMA) which guards key barrier at 107.88 (daily cloud top).

Res: 106.92; 107.15; 107.51; 107.88

Sup: 106.44; 105.98; 105.20; 105.00