WTI oil is on course for the second weekly bullish close despite recovery stall

WTI oil traded in a bumpy mode within nearly $2 range on Friday, as fresh upside attempts after larger recovery stalled and past two days ended in red, were short-lived.

Oil price is trying to regain traction after terrible US jobs data, as optimism is rising on easing lockdown measures and production cut help in balancing oil sector.

In addition, Saudi Arabia raised its official oil prices that could help in keeping oil price afloat.

Another encouraging signal comes from weekly chart as WTI contract is heading towards the second consecutive weekly bullish close after the price dipped below zero level.

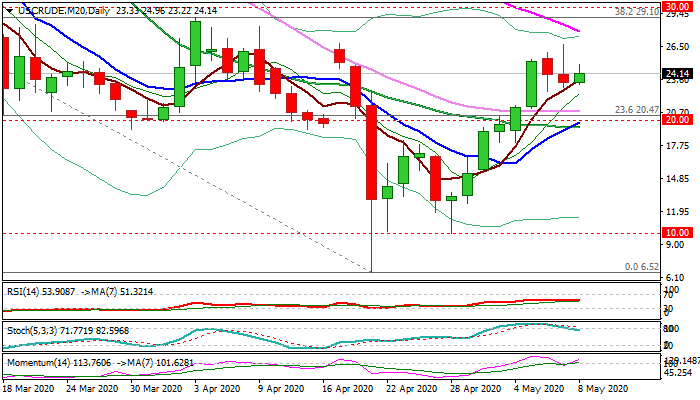

Pivotal barriers lay at $26.82 (17 Apr high) and $27.91 (falling 55DMA), followed by more significant $29.10 (Fibo 38.2% of $65.63/$6.52) and psychological $30 level.

Bulls should ideally hold above Wednesday’s low ($22.56), but extended dips towards 30DMA ($20.84) cannot be ruled out.

Only close below psychological $20 level and 20DMA ($19.43) would weaken near-term structure.

Res: 24.96; 26.71; 26.82; 27.91

Sup: 23.00; 22.56; 21.40; 20.84