Bitcoin – bears a taking a breather after strong fall on Friday

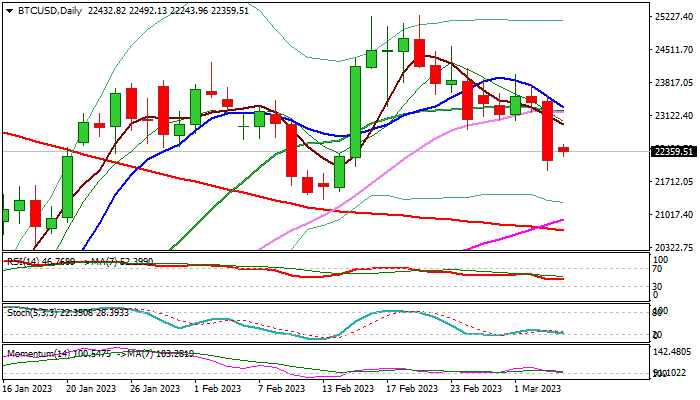

Bitcoin is consolidating after strong fall last Friday (down 5.3% for the day, the biggest daily drop since Nov 9) and keeping negative tone.

The price fell below 22000 mark (although manage to register a marginal close above this level) retracing over Fibo 76.4% of the recent 21336/25244 upleg.

Friday’s large bearish daily candle weighs on price action, as near-term focus shifted to the downside.

Weakening daily studies (falling 14-d momentum is about to break into negative territory / RSI is below neutrality zone and daily Tenkan-sen crossed below Kijun-sen), maintaining bearish near-term tone.

On the other hand, short-term action remains within larger 21336/25244 consolidation range, lacking direction.

Fresh bears pressure initial support at 21827 (Fibo 38.2% of 16300/25244), violation of which would open way for test of key support at 21336 (Feb 13 low / range floor).

Limited consolidation needs repeated close below pivotal barrier at 22828 (broken Fibo 61.8% / Feb 24 low) to keep bears intact for fresh push lower.

Conversely, return and close above 22828 would ease downside pressure and unmask upper pivots at 23202/23283 (converging 20/10DMA’s) break of which will bring bulls back to play.

Res: 22828; 23283; 23599; 23987

Sup: 22258; 21827; 21336; 20903