Gold rose to three-week high ahead of key events -Fed Powell’s testimony / US labor report

Gold is holding positive tone in early Monday, with price action consolidating within a narrow range, under new three-week high.

The metal rallied 1.1% on Friday and advanced 2.5% last week, though investors remain cautious and focus on this week’s key events – Fed Chair Powell’s testimony to Congress on Tue/Wed and US labor report, due on Friday, which are expected to provide fresh direction signals.

Weaker dollar lifted gold in past few sessions, but the greenback’s outlook remains positive on prospects for further rise in US interest rates, which would diminish gold’s appeal.

Recent economic data showed that inflation is stubbornly high and the US economy remains resilient, setting the stage for the central bank’s action in further tightening of the monetary policy.

Bullish scenario for the yellow metal will require calmer tones from Fed Powell and weaker than expected US non-farm payrolls numbers in February, to offer fresh support and lift gold price further.

Conversely, recent bulls are expected to face strong headwinds and likely stall, if Fed’s Chief remains hawkish and NFP report beats expectations.

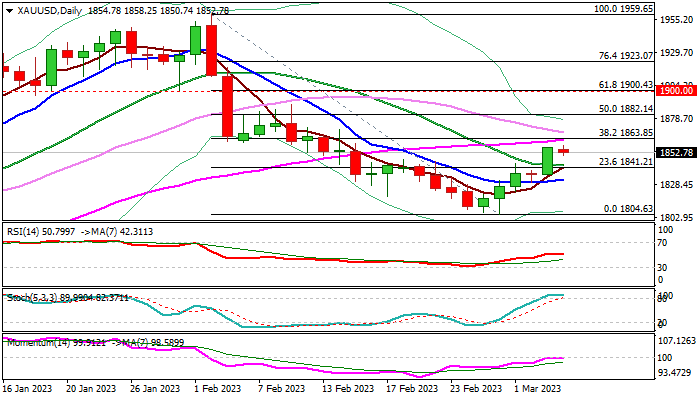

Technical studies on daily chart are bullishly aligned (14-d momentum broke into positive territory, price action closed above 20DMA on Friday and rose further into thick and ascending daily Ichimoku cloud), though still require more evidence to confirm bullish stance that keeps the downside vulnerable.

Last week’s rally formed a bullish engulfing pattern on weekly chart, which adds to supportive factors, with near-term bullish bias expected to hold while the price stays above daily cloud base ($1836).

Immediate resistance lays at $1863 (Fibo 38.2% retracement of $1959/$1804 descend / weekly Ichimoku cloud top), break of which would firm near-term structure for extension towards $1882 (50% retracement / daily Kijun-sen) and unmask next pivotal barriers $1894/$1900 (daily cloud top / Fibo 61.8% / psychological).

On the other hand, return below the base of rising daily cloud ($1836) would generate initial signal of recovery stall, with extension and close below 10DMA ($1832) to confirm and increase risk of renewed attack at key $1800 support zone.

Res: 1863; 1870; 1882; 1894

Sup: 1850; 1843; 1836; 1832