Aussie dollar stands at the back foot ahead of RBA policy meeting

Australian dollar dips on Monday, dragged lower by weaker Chinese yuan, but remains within a congestion which extends into sixth straight day.

Traders await RBA’s policy meeting (due early on Tuesday) for fresh signals, as the central bank is widely expected to raise interest rates by 25 basis points to 3.60% (the highest since Jan 2012).

More important signal for Aussie is expectation that the RBA will hike again in the second quarter and push the interest rate higher than initially estimated.

The central bank’s action should offer fresh support to the currency, although, the US Federal Reserve is also seen remaining on extended policy tightening path, with more aggressive action not ruled out that would offer stronger support to the greenback and limit gains of its Australian counterpart.

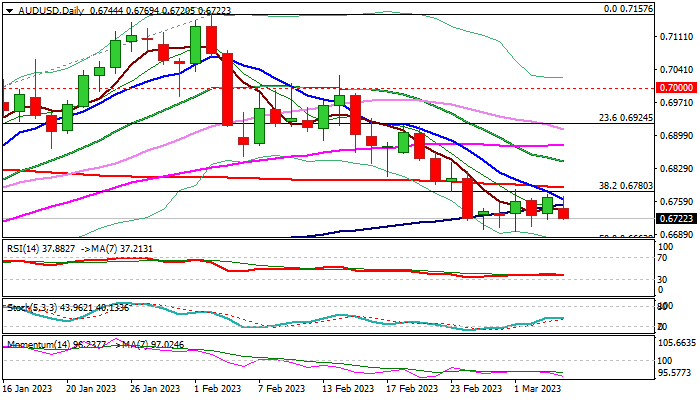

Bearish daily studies (rising negative momentum / MA’s back to full bearish setup) keep Aussie under pressure for renewed attack at recent range floor (0.6694) and extension towards 0.6663/29 (50% retracement of 0.6170/0.7157 ascend / Dec 20 low).

Converging 100/10DMA’s (0.6752/62 respectively) are about to form a bear-cross and mark initial resistance, guarding more significant range top / broken Fibo 38.2% (0.6783) and 200DMA (0.6788).

Firm break of these barriers is needed to sideline downside risk and open way for stronger recovery.

Res: 0.6762; 0.6788; 0.6843; 0.6878

Sup: 0.6694; 0.6663; 0.6629; 0.6584