Bullish bias exists above 109.15/05 support zone

The pair edged higher in Asia on Wednesday, driven by risk sentiment and weaker than expected Japan’s export data which showed the biggest fall in over two years.

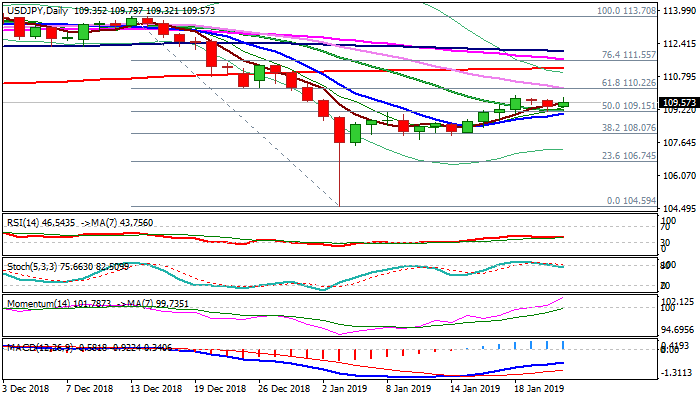

Near-term action holds within 109.15/90 consolidation for the third straight day, after recovery stalled on approach to psychological 110 barrier.

Daily studies maintain strong bullish momentum which supports the action for renewed attempts towards 110 barrier.

The price needs to hold above strong support at 109.15 (broken 50% of 113.70/104.59 / 20SMA) supported by rising 10SMA (currently at 109.05) to keep bullish bias.

Break of key barriers at 110.00/22 (psychological resistance / Fibo 61.8% reinforced by falling 30SMA) is needed to generate bullish signal for extension of recovery leg from 109.59 (3 Jan spike low).

Conversely, near-term structure would weaken on sustained break below 109.15/05 pivots and would risk dip towards 108 support zone.

Res: 109.79; 110.00; 110.22; 110.47

Sup: 109.32; 109.15; 109.05; 108.68