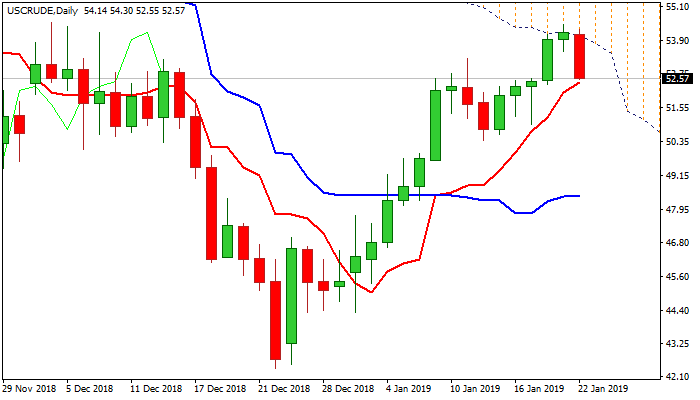

Deeper pullback not ruled out after repeated rejection at daily cloud base

WTI oil holds in red on Tuesday and was down 2.4% since Asian opening, pressured by renewed pessimism over China’s economic growth slowdown and consequent lower fuel demand.

The oil price moved lower after strong technical resistance (base of thick daily cloud at $54.11) repeatedly capped recovery leg from $42.36 low, prompting investors to book profits.

Technical outlook weakened as momentum turned south and created bear-cross with its 7-dSMA and slow stochastic is reversing from overbought territory.

Both indicators signal reversal on formation of bearish divergence in previous two sessions.

Fresh bears pressure rising 10SMA ($52.44) close below which would signal deeper pullback after bulls failed to break into daily cloud.

Deeper dips could extend towards psychological $50 support but need to find ground above to keep larger bulls in play.

Res: 53.72; 54.11; 54.54; 55.55

Sup: 52.44; 52.01; 51.62; 50.97