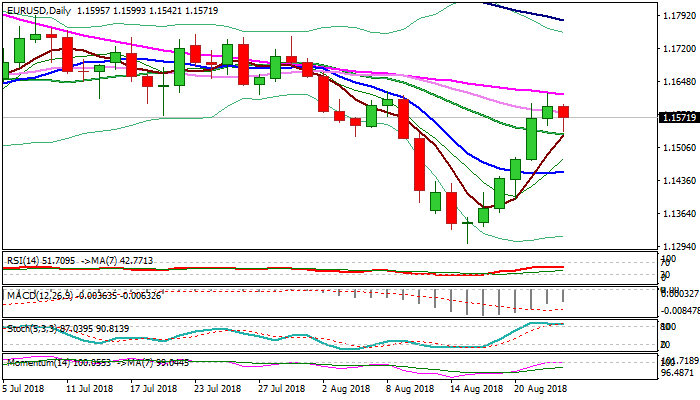

Bullish bias remains in play while 20SMA holds the downside

The Euro is slightly firmer at the beginning of the US session, as weaker than expected EU / German Manufacturing data showed mild impact and so far not reacting on better than expected US weekly jobless claims figures.

Near-term action remains strongly underpinned by rising thick daily cloud, while momentum on daily chart is strengthening and increasing expectations for renewed attack at 55SMA pivot (1.1621), after today’s downside attempts were contained by broken weekly cloud base (1.1525) which marks solid support, reinforced by 20SMA.

Bullish near-term bias is expected to remain in play while the latter supports hold. Conversely, sustained break here would signal deeper correction of 1.1300/1.1623 rally.

Res: 1.1599; 1.1621; 1.1640; 1.1687

Sup: 1.1542; 1.1525; 1.1500; 1.1454