New PM election provides temporary relief, but overall bearish picture keeps the risk skewed lower

The Aussie dollar bounced on Friday, gaining 0.6% in Asia after election of new ruling party leader signaled an end of political crisis.

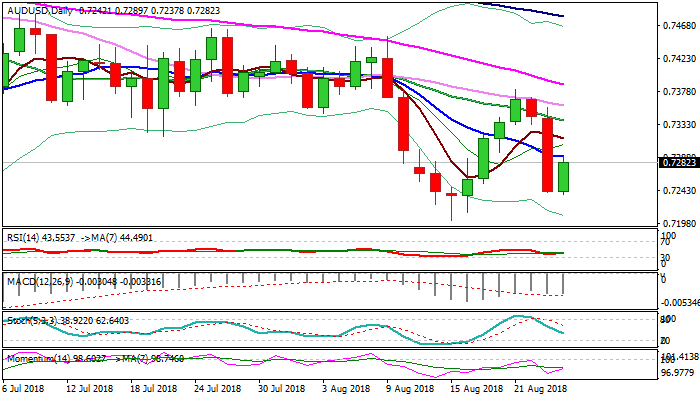

Fresh rally so far retraced nearly 38.2% of bear-leg from 0.7381 in past two days, as Thursday’s fall marked the biggest one-day fall since 14 June.

Immediate risk of retesting key near-term support at 0.7202 (15 Aug low) has eased, but bearish weeklies keep the downside vulnerable.

Fresh momentum underpins the action which attacks 10SMA (0.7289) break of which would signal further recovery towards a cluster of barriers at: 0.7315 (5SMA); 0.7338 (20SMA); 0.7359 (30SMA).

Stronger bullish signal could be expected on break above 0.7381/88 pivots (21 Aug high / falling 55SMA).

Fresh recovery is supported by weaker greenback after US/China trade talks ended without progress, but today’s speech of Fed chairman Powell in Jackson Hole symposium will be closely watched for fresh signals.

Res: 0.7289; 0.7315; 0.7338; 0.7359

Sup: 0.7271; 0.7237; 0.7202; 0.7158