Bullish near-term bias above daily Kijun-sen

The Euro is trading within tight range around 1.07 handle in Europe on Thursday but remains constructive despite easing risk mode in Asia.

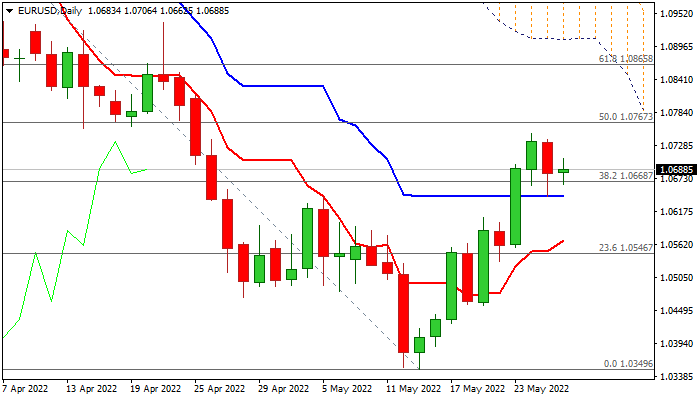

The action stays above broken Fibo barrier at 1.0668 (38.2% of 1.1184/1.0349) and daily Kijun-sen (1.0643) which turned to solid supports and maintain near-term bullish bias.

Daily MA’s (5/10/20) are in bullish setup and formed a multiple bull-crosses that support the action, along with rising bullish momentum.

Bulls eye pivotal barriers at 1.0774/87 (55DMA / Fibo 38.2% of 1.1494/1.0349) to generate fresh positive signals on potential break.

Caution on drop below daily Kijun-sen, while return below daily Tenkan-sen (1.0568) would neutralize near-term bulls.

Repeated hawkish signals from ECB President Lagarde about moving rates from the negative territory and possible further rate hikes in coming months, underpin the action, although the ECB still lacks unity in this idea.

With no releases from the EU scheduled in the morning, trader await US economic indicators, with Q1 GDP, weekly jobless claims and pending home sales, being in focus today.

Res: 1.0748; 1.0767; 1.0787; 1.0800

Sup: 1.0668; 1.0643; 1.0607; 1.0568