Turkish lira falls to new 2022 low vs dollar ahead of CBRT policy meeting

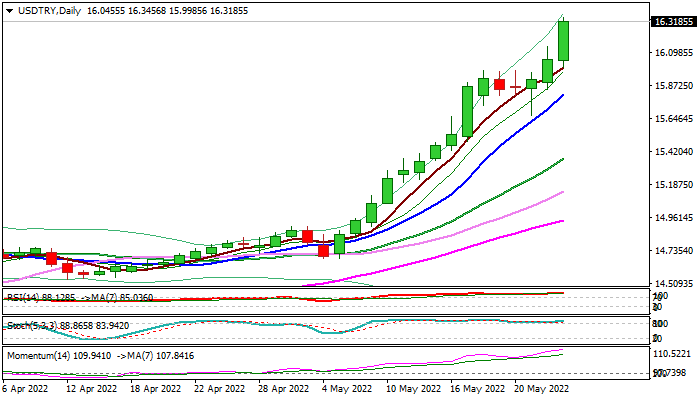

Fresh acceleration higher pushed the USDTRY to new 2022 high at 16.34 on Wednesday, as traders continue to sell lira ahead of tomorrow’s CBRT policy meeting.

Turkey’s central bank is expected to stay on hold this time and leave interest rates at 14%, with policy makers being pressured from two sides, by President Erdogan’s idea of lower interest rates that would boost the economy and skyrocketing inflation, which currently stands at 70%.

The situation in comparison to the previous policy meeting has deteriorated, as prices of crude oil have risen and natural gas and coal prices soared that puts the economy under increased pressure.

Negative fundamentals continue to work against the Turkish lira, while technical studies show strong bullish momentum that supports the USDTRY.

Bulls eye pivotal Fibo barrier at 16.4184 (76.4% of 18.3387/10.2018 drop), break of which would open Dec 17 high at 17.0664 and unmask record high at 18.3387.

Higher base at 16.00 zone offers immediate support, followed by rising daily Tenkan-sen (15.8495) and May 23 higher low at 15.6686, which guard lower pivot at 15.4855 (daily Kijun-sen).

Res: 16.3456; 16.4184; 17.0644; 18.3387

Sup: 16.0000; 15.8495; 15.6686; 15.4855