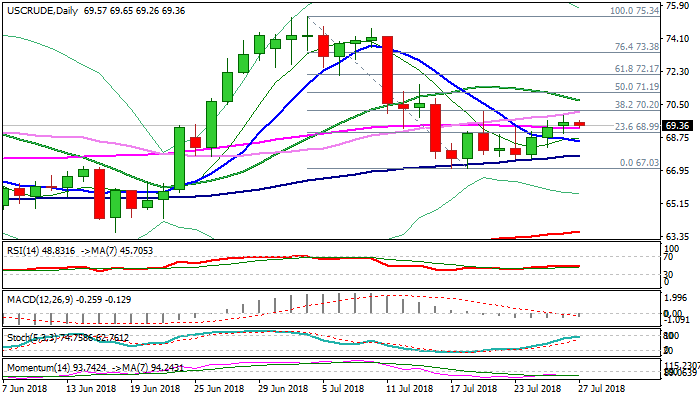

Bullish outlook above broken 55SMA

WTI oil eases from one-week high at $69.90 on Friday but remains constructive above broken 55SMA ($69.22).

Thursday’s eventual break above 55SMA which marked the top of week-long congestion, was bullish signal. Bulls require extension above pivots at $70.00/20 (psychological / Fibo 38.2% of $75.34/$67.03 fall) to confirm break and signal continuation of recovery from $67.03.

Broken 55 SMA marks initial support at $69.22, with deeper dips expected to find ground above 10SMA ($68.53) and keep bulls in play.

Daily studies are mixed and still lacking clear direction signal, but fundamentals are supportive.

Constructive trade talks between the US and EU which move cutting trade barriers between two countries and news that Saudi Arabia is suspending oil shipments through the Red Sea, accompanied by strong falls in crude inventories, keep oil prices supported.

Focus turns on release of Baker Hughes report later today, which counts US oil rigs and could provide fresh signals for the oil price.

Res: 69.65; 69.90; 70.20; 70.73

Sup: 69.22; 68.92; 68.53; 68.19