EURUSD ticks higher after US data but risk remains skewed lower

The Euro was higher in post-data 1.1620/50 advance, after US GDP came in line with expectations (4.1%) with previous release being upward-revised from 2.0% to 2.2%.

Fresh dollar’s weakness could be explained as disappointment of traders who expected stronger figure, but it looks like short-lived action as EURUSD’s overall picture is bearish and bounce could be seen as positioning for fresh push lower on likely ‘buy rumor -sell fact’ scenario.

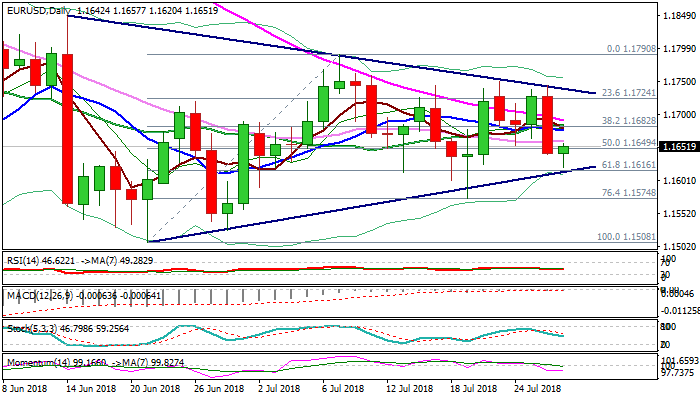

The price remains under the base of thick daily cloud (1.1680) reinforced by plethora of daily MA’s, which is expected to cap upticks and keep bearish stance (also reinforced by negative momentum) intact.

Bears need close below triangle support (1.1616) to confirm continuation and unmask next supports at 1.1574 and 1.1527.

Stronger rally and close within the cloud is needed to neutralize immediate downside risk.

Res: 1.1662; 1.1680; 1.1718; 1.1741

Sup: 1.1616; 1.1574; 1.1527; 1.1508