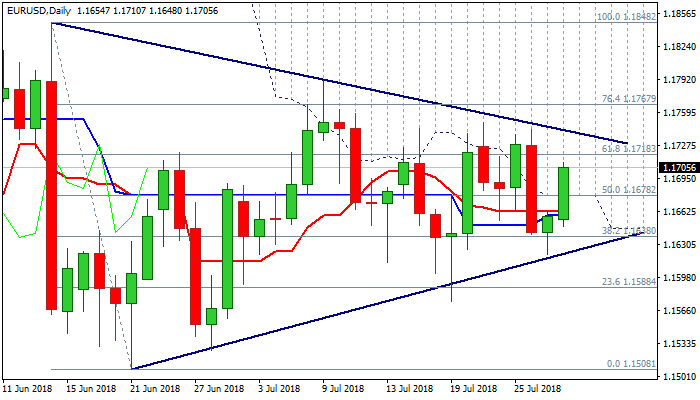

Bullish tone in early US trading as fresh bullish acceleration penetrated daily cloud

The Euro stands at the front foot in early US trading and probes above 1.17 barrier. Fresh strength was sparked by solid German CPI data and weaker dollar, broke through a cluster of daily MA’s and penetrated thick daily cloud, which shifted immediate focus higher.

Close within daily cloud would generate bullish signal for attack at the upper triangle boundary (1.1742) after downside attempts were rejected last Friday on triangle support line (1.1620).

Improved daily techs are supportive, but overbought conditions on lower timeframes warn of stall ahead of triangle upper border.

The pair would look for a catalyst which could spark stronger acceleration and result in clearer direction signal on break of either side of triangle.

Tuesday’s release of German jobs data and EU CPI is in focus, with Fed’s rate decision on Wednesday, seen as key event.

Res: 1.1718; 1.1742; 1.1767; 1.1790

Sup: 1.1678; 1.1648; 1.1628; 1.1574