Bulls are back to play and eye key 1.30 barrier

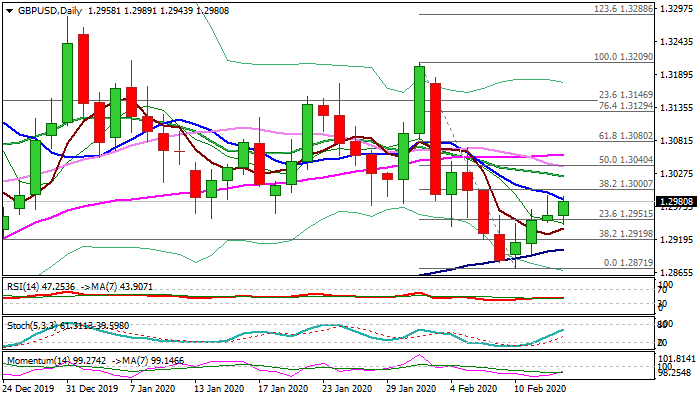

Cable regained traction and edged higher on Thursday, keeping near-term focus at the upside and averting risk of formation of shooting star reversal pattern on daily chart, after Wednesday’s action stalled on approach of key 1.30 barrier and left daily inverted hammer

Upbeat UK house price data (RICS Jan 17 vs 3 f/c and -2 in Dec) which showed the highest reading since May 2017, inflated pound in early Thursday’s trading.

Daily techs are still mixed but outlook improves on rising momentum and cracked 10DMA (1.2984) as fresh bulls pressure again 1.30 pivot, close above which would generate strong signal for extension of recovery leg from 1.2871 low (10 Feb).

Rising 5DMA offers support at 1.2938, guarding more significant 100DMA (1.2903).

Res: 1.2991; 1.3000; 1.3040; 1.3080

Sup: 1.2950; 1.2938; 1.2903; 1.2871