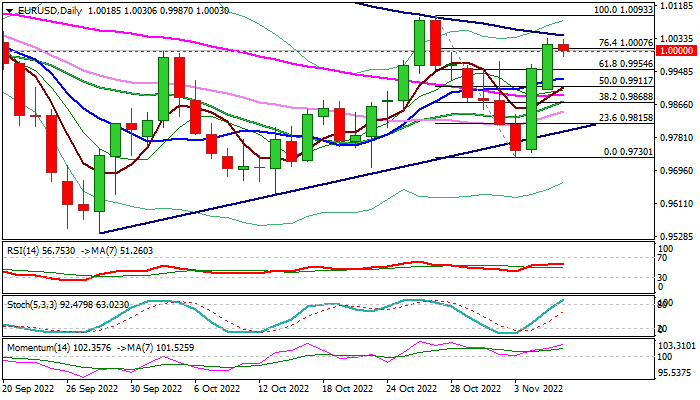

Bulls are consolidating ahead of fresh push higher

Bulls are taking a breather for consolidation after advancing 2.7% in past two days (Friday’s rally was the biggest daily gain since June 2016).

Initial strong bullish signal was generated on Friday’s close above thick daily cloud and boosted by Monday’s upside extension and close above parity level, suggesting that rally could extend further.

Bullish daily studies support the action, but overbought conditions may keep bulls on hold for consolidation, after the action faced headwinds on approach to falling 100DMA (1.0041).

Dips should find ground above daily cloud top (0.9954, also broken Fibo 61.8% of 1.0093/0.9730) to keep bullish bias for push through 100DMA and attack at key near-term barrier at 1.0093 Oct 26/27 double-top).

Res: 1.0041; 1.0093; 1.0179; 1.0198

Sup: 0.9987; 0.9954; 0.9930; 0.9911