Bulls are pausing under key barriers

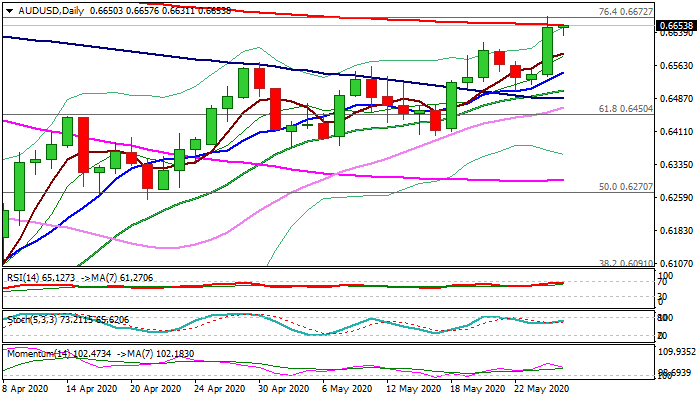

Bulls are taking breather on Wednesday after Tuesday’s 1.5% advance and holding within tight consolidation under key barriers at 0.6655/72 (200DMA / Fibo 76.4% of 0.7032/0.5509) which were cracked but so far resist.

Renewed risk mode on hopes that post-pandemic recovery will gain pace, keep the Aussie afloat and limit dips for now, however, weaker CNY (dropped to 8-month low) and rising tensions over Hong Kong, keep traders cautious.

Overall bullish setup of daily studies keep the upside favored, but break above 0.6655/72 pivots is needed to confirm bulls and signal extension of larger recovery leg from 0.5509 (19 March low).

There is enough space at the downside for dips, with former high at 0.6616 and 5DMA (0.6588) expected to ideally hold and keep bulls intact.

Only break and close below rising 10DMA (0.6546) would dent bullish bias and generate initial signal of recovery stall.

Res: 0.6656; 0.6672; 0.6684; 0.6750

Sup: 0.6657; 0.6616; 0.6576; 0.6526