Bulls remain in play but unable to extend higher

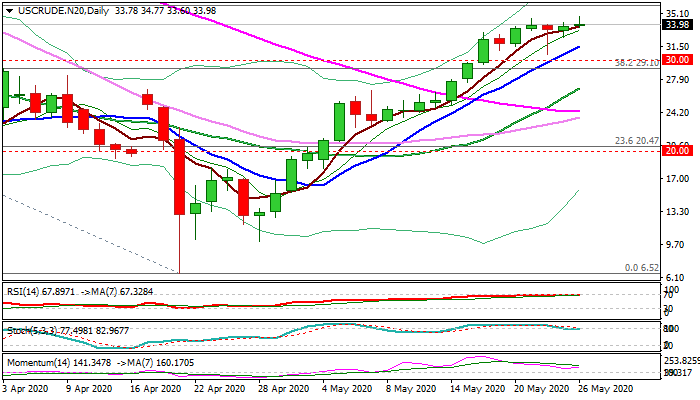

WTI oil maintains positive tone on rising optimism as global re-opening after pandemic lockdown boosts demand, but bulls struggle at recovery highs (marginally higher high at $34.77 was posted today but the price subsequently pulled back below $34 handle).

Traders focus on June’s OPEC meeting where the main theme will be extension of production cut agreement which is one of key factors in stabilizing oil markets.

Daily techs send mixed signals as bullish momentum exists, although weaker, but stochastic and RSI reverse from overbought zone, suggesting further sideways trading and possible dips.

Rising 10DMA tracks the advance since late Apr and offers solid support at $31.55, guarding lower pivots at $30/$29.10 (psychological / broken Fibo 38.2% of $65.63/$6.52).

Bulls need break above $36.08/$37.00 (50% retracement / falling 100DMA) to generate bullish signal for recovery extension.

Res: 34.77; 35.00; 36.08; 37.00

Sup: 33.68; 32.46; 31.55; 30.00