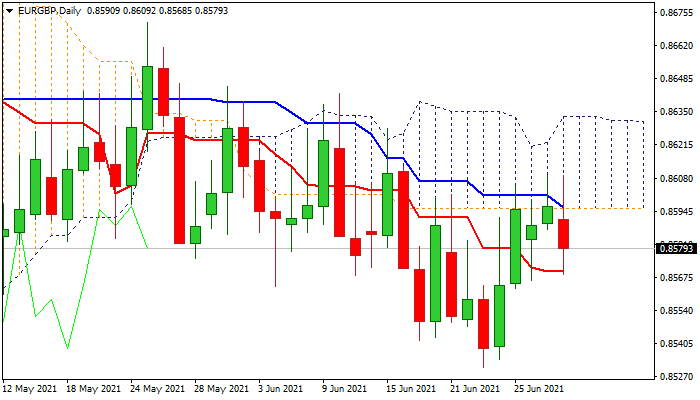

Bulls continue to struggle at daily cloud base / bear-channel upper boundary

Near-term action remains limited by daily cloud (spanned between 0.8595 and 0.8633) for the fourth consecutive day, as repeated penetrations into the cloud were so far short-lived.

Upside was additionally limited by the upper trendline of bearish channel from 0.8671 (May 25 high) that could generate signal of bull-trap pattern.

Bearishly aligned daily studies add to scenario of recovery stall and fresh weakness that would keep the price within the bearish channel.

Bears need close below daily Tenkan-sen (0.8569) to signal reversal and shift focus towards 0.8530 (June 23 low).

Weekly chart shows a series of Doji candles but in descending mode that suggests bears remain in control although still lacking clearer direction signals.

Res: 0.8595; 0.8609; 0.8633; 0.8642

Sup: 0.8570; 0.8530; 0.8485; 0.8472