Bulls eye November’s high as risk sentiment on vaccine persists

The Euro extends recovery on Monday and hit one-week high, boosted by risk appetite on corona-virus vaccine and hopes for a free-trade agreement within the world’s largest trade bloc, formed by fifteen Asia-Pacific economies, that for now offsets negative impact from raging coronavirus.

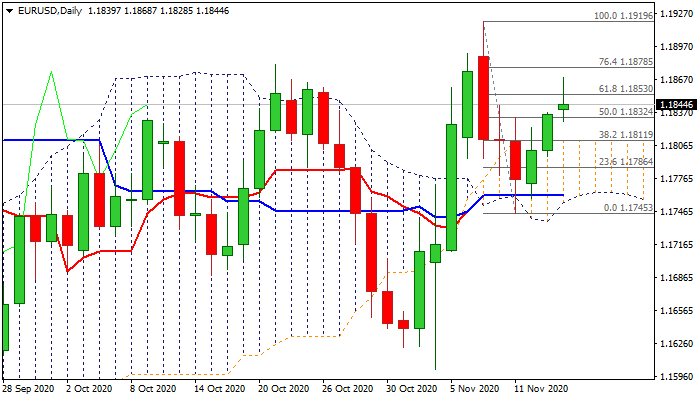

Bulls are set for retest of November’s high at 1.1919, with near-term action being supported bullish daily studies (rising bullish momentum; multiple MA bull-crosses.

Friday’s close above daily cloud adds to positive near-term outlook.

Important Fibo barrier at 1.1853 (61.8% of 1.1919/1.1745 bear-leg) was cracked today, with close above here to generate fresh positive signal and further underpin the action, which eyes 1.1878 (Fibo 76.4%) the last significant obstacle en-route to 1.1919 target.

Broken daily cloud top / Fibo 38.2% (1.1812) mark strong support which needs to hold and keep bulls in play.

Res: 1.1853; 1.1878; 1.1890; 1.1919

Sup: 1.1832; 1.1812; 1.1800; 1.1783