Bulls in play above 200WMA; US NFP data to provide fresh direction signal

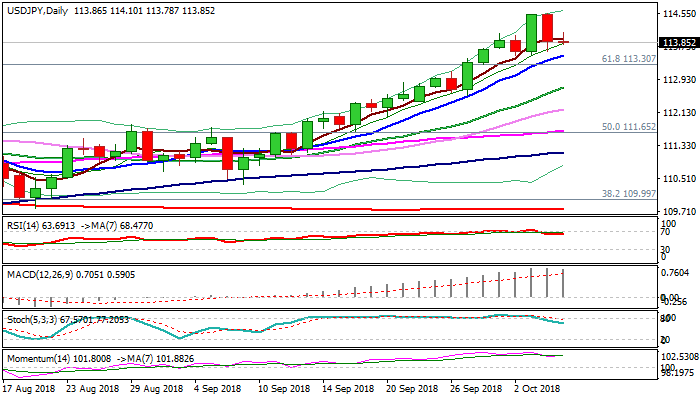

Thursday’s close in in red on pullback from double upside rejection at 114.54 (11-month high) was so far seen as positioning for fresh advance, as dip found footstep above initial support at 113.52 (rising 10SMA).

Overall picture remains biased higher as bulls are comfortable above broken weekly 200SMA (113.18) which marks key near-term support.

The greenback remains supported by recent strong US data and US / Japan interest rate gap expected to widen further.

Friday’s action holds within narrow range, awaiting release of US jobs data for fresh signal.

Upbeat release would prompt bulls for test of initial target at 114.73 (06 Nov 2017 high) with 115+ gains seen on stronger acceleration higher.

Conversely, extension and close below 200SMA would sideline bulls and signal deeper pullback.

Res: 114.10; 114.54; 114.73; 115.00

Sup: 113.78; 113.52; 113.30; 113.18