Bulls may accelerate on clear break of 130 pivot, Fed eyed for fresh signal

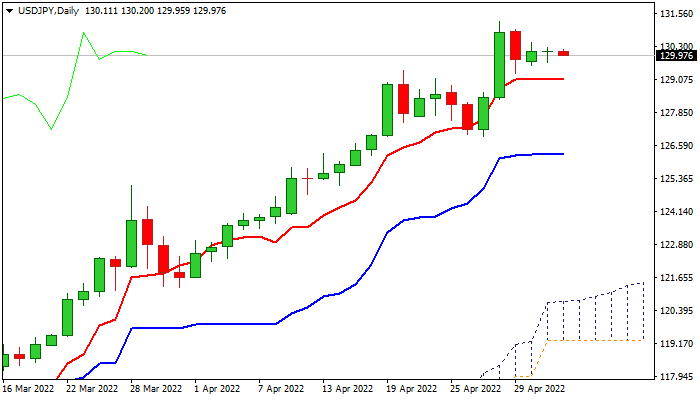

Bulls are taking a breather after a massive 13% advance in past two months cracked psychological 130 barrier but failed to register a monthly close above here.

Consolidation should be ideally contained by sideways-turned daily Tenkan-sen (129.09) to keep bulls intact for push through pivots at 130.00 and 130.65 (psychological / Fibo 76.4% of 147.68/75.55 bear-phase) and acceleration towards 2002 peak at 135.16.

Fed’s policy meeting is key risk event and decision is likely to spark fresh advance of the dollar, if the central bank maintains its hawkish stance for a several rate hikes in coming months.

However, deeper pullback on profit-taking from dollar’s 20-year high, remains on the table as possible scenario, especially if chief Powell’s comments about the central bank’s future steps disappoint markets.

Larger structure is expected to remain bullish if extended dips find ground above key supports at 127.60/126.94 (rising 20DMA / Apr 27 trough), while break here would generate initial reversal signal and lead to a deeper correction.

Res: 130.47; 130.65; 131.24; 132.17

Sup: 129.09; 128.33; 127.60; 126.94