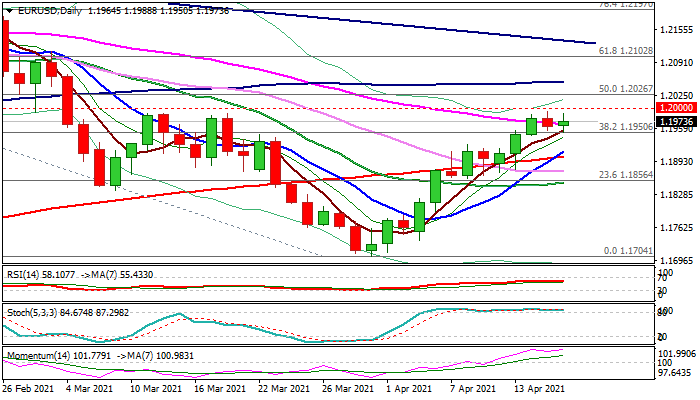

Bulls remain in play and consolidate ahead of fresh attack at key 1.20 zone

The Euro regained traction on Friday and edged higher, minimizing negative impact from Thursday’s close in red which signaled that bulls are running out of steam ahead of key barriers at 1.2000/06 (psychological / daily cloud base).

The uptrend from 1.1704 (Mar 31 low) show signs of fatigue as stochastic is strongly overbought, but rising bullish momentum and formation of 10/200DMA’s golden cross continue to underpin and partially offset negative signal.

This suggests that bulls may stay in extended consolidation before fresh attack at 1.20 zone, break of which would expose targets at 1.2051/92 (100DMA / daily cloud top).

The consolidation should ideally stay above 1.1950 (broken Fibo 38.2% of 1.2349/1.1704 / rising 5DMA), with deeper dips to stay above rising 10DMA (1.1913) to keep bulls intact.

Only break of 200DMA (1.1903) would sideline bulls.

Res: 1.1973; 1.1990; 1.2000; 1.2024

Sup: 1.1950; 1.1927; 1.1913; 1.1903