Sterling eases on firmer dollar / profit-taking

Cable was sold in early European trading on Friday, as pound came under pressure from signs that City was hit worse than expected by Brexit that prompted traders to collect profits from four-day rally.

Some 440 financial firms in Britain have shifted activities and staff (around 7400 jobs have moved from Britain) to hubs in the European Union, with the numbers expected to increase over time.

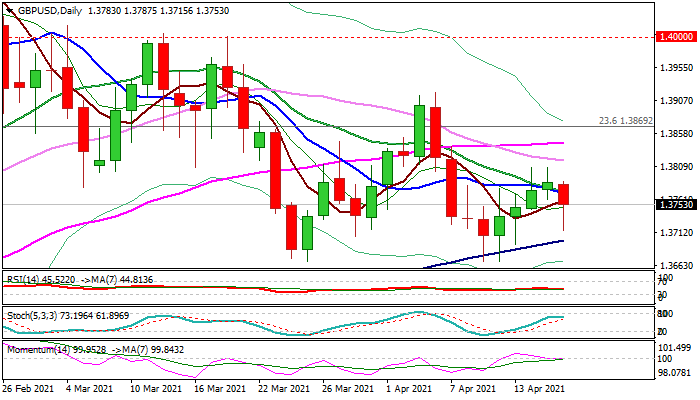

Technical studies are weakening on daily chart following a double failure to break important 1.3800 resistance zone (daily Tenkan-sen capped the action) with momentum breaking into negative territory and RSI turned south.

Fresh bears eye pivotal 100DMA support (1.3700) loss of which would confirm and end of corrective phase (1.3670/1.3800) and open way for retest of key supports at 1.3670 (double-bottom).

Bears will also need a confirmation on eventual weekly close below rising 20WMA (1.3706) which held the action since late June.

Converged 10/20DMA’s (1.3772) offers initial resistance which is expected to cap and keep fresh bears in play.

Only firm break of 30DMA (1.3818) would bring bulls back to play.

Res: 1.3772; 1.3808; 1.3818; 1.3844

Sup: 1.3715; 1.3700; 1.3670; 1.3641