Bulls remain intact and look for final close above 200WMA to resume

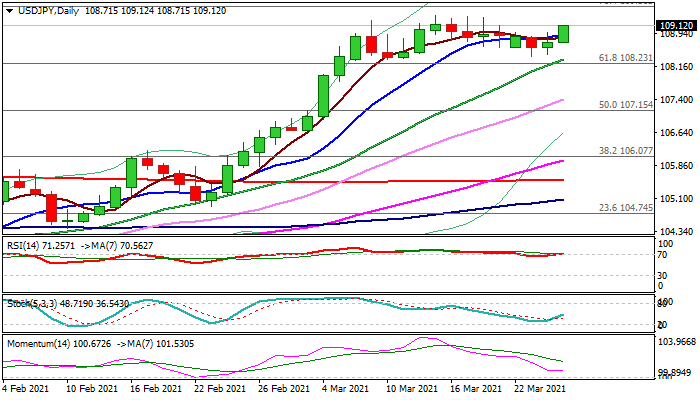

The pair maintains bullish tone and fresh advance above 109 mark (200WMA / Fibo 61.8% of 109.36/108.40 pullback) in early Thursday’s trading signals that shallow correction from new 2021 high (109.36) might be over.

Near-term action remains biased higher as dips were contained above important support at 108.23 (broken Fibo 61.8% of 111.71/102.60, reinforced by rising 20DMA).

Bulls need eventual close above 200WMA (after repeated failures in past two weeks) to signal bullish continuation and extend an uptrend from 102.59 (Jan 6 low).

Break of initial barriers at 109.36/56 (Mar 15 high / Fibo 76.4% of 111.71/102.59) would open way for test of 109.85 (June 5 high) and psychological 110 level.

Daily studies reinforce bullish bias but caution on overbought weeklies and potential third straight failure to close above 200WMA.

Res: 109.36; 109.56; 109.85; 110.00

Sup: 109.00; 108.61; 108.40; 108.23