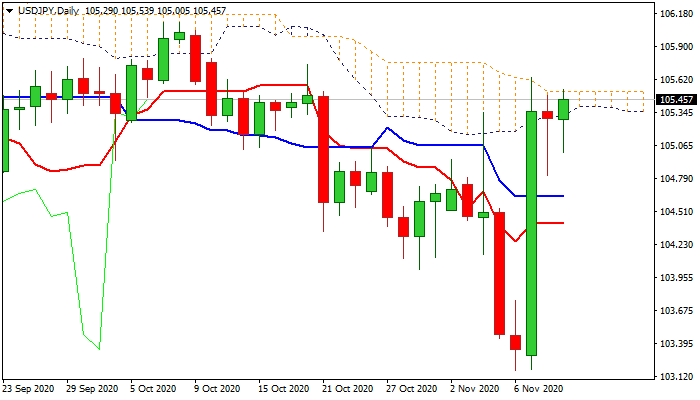

Bulls remain underpinned by massive Monday’s candle and look for eventual lift above daily cloud

The pair extends consolidation into second consecutive day, following Monday’s surge (up 2%) on Covid-19 vaccine news.

Today’s action so far is holding positive tone, with long tails of today’s / Tue daily candles, signaling that the downside was so far well protected.

Bulls need close above daily cloud (which caps the action for now) to signal continuation and neutralize existing fears of rally’s stall.

Sustained break of daily cloud would trigger stops and accelerate towards falling 100DMA (105.85) and open way for 106+ gains.

Fading bullish momentum on daily chart, overbought stochastic and sideways-moving RSI continue to warn that bulls may be running out of steam as post-vaccine news euphoria in the market has peaked.

Repeated failure to clear daily cloud would keep in play risk of stall, with further negative signals to be generated on loss of 105.03 (30DMA) and more significant supports at 104.76/70 (20DMA / Fibo 38.2% of 103.17/105.64 ascend.

Res: 105.53; 105.64; 106.10; 106.50

Sup: 105.03; 104.81; 104.70; 104.41