Near-term bears remain in play but require confirmation on close below key Fibo support

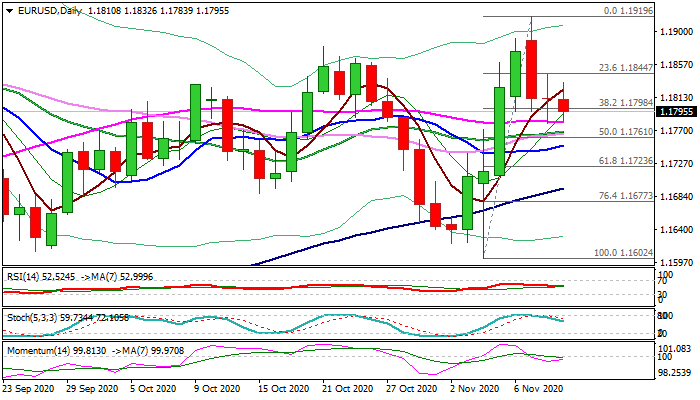

The Euro remains in red on Wednesday and probes again through cracked Fibo support at 1.1798 (38.2% of 1.1602/1.1919 ascend) after Tuesday’s action ended in long-legged Doji, signaling strong indecision.

Monday’s bearish engulfing weighs on near-term action, as markets fear of further reduction of longs towards the end of the year that could push the price further down.

Near-term bears look for initial signal on close below key supports at 1.1811 (daily cloud top) and 1.1798 (Fibo) to spark fresh acceleration towards next key supports at 1.1740/23 (daily cloud base / Fibo 61.8% of 1.1602/1.1919).

On the other side, daily studies remain mixed and lack clearer direction signals, with positive bias expected to remain in play if today’s action fails to clearly break 1.1798 pivot.

Res: 1.1811; 1.1843; 1.1890; 1.1919

Sup: 1.1779; 1.1760; 1.1740; 1.1723