Bulls show signs of stall by further signals needed confirm pullback

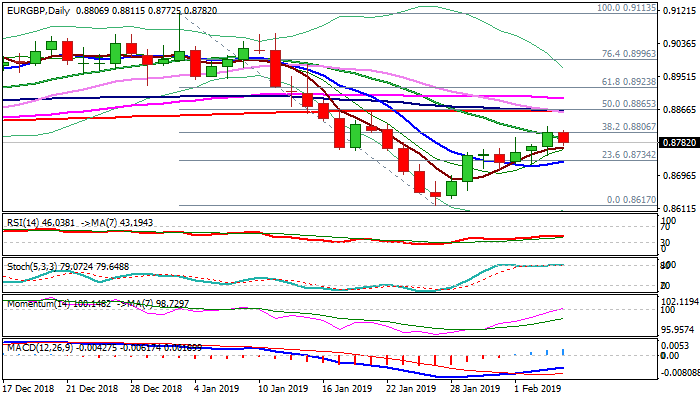

The cross eases on Wednesday after 1 ½ week recovery rally showed signs of stall at pivotal Fibo barrier at 0.8806 (38.2% of 0.9113/0.8617).

Repeated failure to clearly break higher resulted in fresh weakness, as the single currency came under increased pressure after strong fall in German factory orders (that also sent European stocks lower), while pound’s bears found footstep ahead of strong support and negative sentiment weakened on hopes of delayed Brexit (from 29 Mar to 24 May).

The price returned below 20SMA following brief probe above, with daily close below the MA, to generate initial bearish signal.

Conflicting daily studies (momentum heads north and breaking into positive territory, while stochastic is reversing from overbought territory after forming bearish divergence) provide no clear direction signal for now.

Bearish scenario requires today’s close in red (possibly to form bearish outside day) and below 20SMA, to signal stronger correction of 0.8617/0.8821 upleg, as the formation of bear-cross of falling 30SMA over converged 100/200SMA’s weighs.

Alternatively, lift and close above 20 SMA and 0.8806 Fibo barrier, would neutralize downside risk and signal continuation of recovery leg from 0.8617 (25 Jan low).

Res: 0.8806; 0.8821; 0.8863; 0.8895

Sup: 0.8768; 0.8731; 0.8711; 0.8656