Risk of deeper pullback on stronger than expected build in US oil inventories

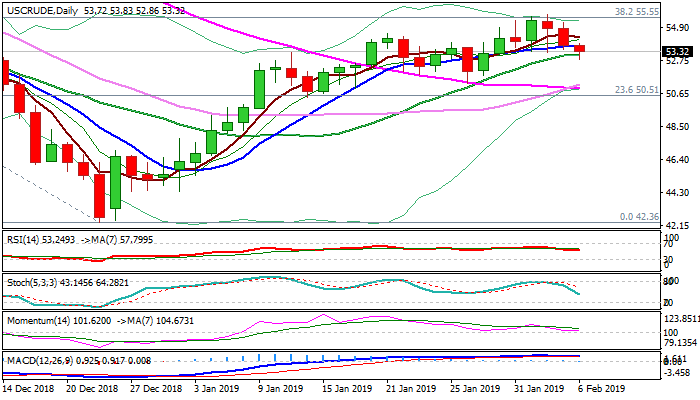

WTI oil stands at the back foot on Wednesday and extends weakness of past two days from new 2019 high at $55.73.

Fresh weakness cracked significant support at $53.12, but without clear break lower so far.

Momentum continues to weaken on daily chart and along with south-heading slow stochastic, produces negative signal.

Build of crude stocks by 2.5 million barrels vs last week’s build of 2.09 million barrels (API report, released on Tuesday) added to negative near-term outlook, with focus on EIA crude inventories report, due later today (2.17 million barrels build f/c vs 0.9 million barrels build last week).

Upside surprise would put oil price under increase pressure and risk retest of key 200WMA support ($52.36), while lower than expected rise in US crude stocks would ease current bearish pressure.

The price may hold in extended consolidation before renewed attempt towards pivotal $55.55 Fibo barrier, where larger recovery was rejected.

Caution on bearish divergence on daily momentum which signals stronger dip.

Loss of 200WMA ($52.36) and 28 Jan trough ($51.32) is needed to generate stronger bearish signal.

Res: 53.74; 54.24; 55.55; 55.73

Sup: 53.12; 52.36; 51.83; 51.32