Bulls take a breather ahead of key US GDP data

Gold price eases from new multi-month high ($1949) in European trading on Thursday, as larger bulls take a breather ahead of release of key US GDP data.

The US economy is expected to show growth of 2.6% in the last three months of 2022, down from 3.2% expansion in Q3, which adds to signals of slowing US economy.

In such scenario, the Fed would opt for further easing in its policy tightening cycle and go for 25 basis points hike on Feb 1 policy meeting, compared to 0.5% raise in the last meeting.

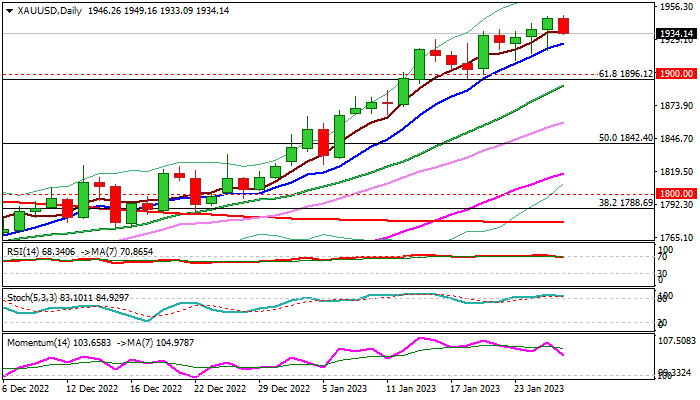

Lower rates would deflate dollar and help bullion to extend its three-month strong rally, with targets at $1962/$2000 (Fibo 76.4% of $2070/$1614 / psychological).

Rising 10DMA ($1925) offers initial support, with extended dips to find ground above $1900 to keep bulls in play and mark pullback as a healthy correction.

Res: 1949; 1962; 1971; 2000

Sup: 1925; 1900; 1896; 1890