Cable dips after BoE’s dovish hold

Cable fell below 1.2700 marks and hit the session low on Thursday, after the BoE kept rates unchanged but markets saw it as a dovish hold which deflated pound.

The fact that inflation returned to 2% target in May did not play the key role in BoE today’s decision, as the policymakers remain cautious and look for more evidence, before start easing the borrowing cost from its multi-year high.

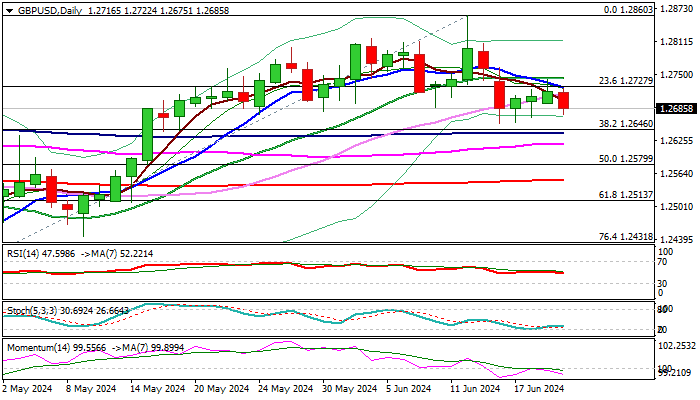

Technical picture weakened as 14-d momentum is heading deeper into negative territory and converging daily Tenkan/Kijun-sen are about to form a bear-cross, while next week’s daily cloud twist could also be magnetic (cloud is below the price).

However, near-term action is holding within a range which extends into fourth straight day, with break of range floor (1.2656) and nearby Fibo support and 100DMA (1.2646/39), to generate bearish signal for continuation of the bear-leg from 1.2860 (June 12 spike high) and expose targets at 1.2596/80 (daily cloud top / 200DMA).

Bearish near-term bias expected while the price holds below descending 10DMA (1.2724) while sustained break above 20DMA (1.2742) to put bears on hold.

Res: 1.2724; 1.2742; 1.2763; 1.2807

Sup: 1.2656; 1.2639; 1.2596; 1.2580