EURUSD falls further on downbeat PMI data

EURUSD fell to one week low on Friday and extended strong fall of Thursday, after the pair came under fresh pressure from downbeat PMI data.

The reports released on Friday showed that activity in services industry in the Eurozone and bloc’s two largest economies – Germany and France slowed in June, while downturn in manufacturing sector gained pace, to further weaken overall dark picture.

Weak data signal that the latest ECB rate cut (25 basis points on June 6 policy meeting) had so far no positive impact on economic activity and suggest that the recovery would be long and difficult.

The single currency fell further as downbeat data further soured the sentiment.

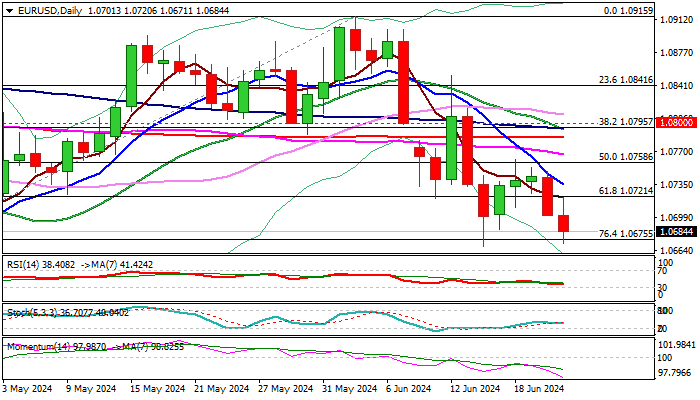

Bears probed again through Fibo support at 1.0675 (76.4% of 1.0601/1.0915), with close below this level to open way towards key support at 1.0601 (2024 low, posted on Apr 16).

Technical studies on daily chart are in full bearish setup (strengthening negative momentum / multiple MA bear-crosses) and support the action, with falling 10DMA (1.0735) offering solid resistance and expected to ideally cap upticks and guard upper pivots at 1.0767/85 (55/200DMA’s respectively).

Limited upticks would also keep larger bears intact and offer better levels to re-enter bearish market.

Res: 1.0721; 1.0735; 1.0767; 1.0785

Sup: 1.0667; 1.0649; 1.0624; 1.0601