Cable dips to one-week low ahead of UK data

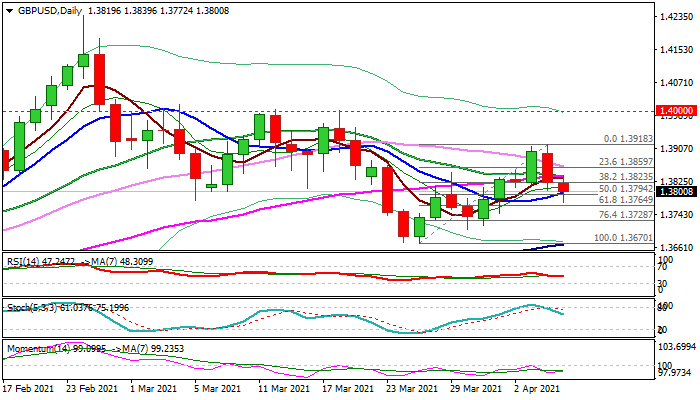

Cable holds in red for the second day and fell to one-week low (1.3772) in early European trading on Wednesday, in extension of Tuesday’s 0.53% drop.

Recovery stall and subsequent weakness point to a bull-trap above 1.3887 Fibo barrier (38.2% of 1.4238/1.3670) that weighs on near-term action.

Fresh weakness cracked pivotal support at 1.3794 (50% retracement of 1.3670/1.3918 / 10DMA) with today’s close below here to add to negative signals and keep near-term bias with bears.

Studies on 4-hr chart are in negative setup and signal further weakness but daily techs are still mixed as momentum remains negative but the action remains within thick daily cloud (spanned between 1.3712 and 1.3795).

Extension below 1.3764 (Fibo 61.8% of 1.3670/1.3918) would further weaken near-term structure and risk test of key supports at 1.3712 (cloud base) and 1.3670 (Mar 25 low / 100DMA).

At the upside, converged 5/20/55DMA’s mark solid barrier at 1.3837, with firm break here to shift focus higher.

Release of UK Composite and Services PMI’s is the key event for sterling today. Forecasts for March are unchanged from previous month’s figures and surprise on either side would impact pound’s performance.

Res: 1.3837; 1.3862; 1.3887; 1.3918

Sup: 1.3794; 1.3772; 1.3764; 1.3728