Cable eases from new 2023 top, UK CPI data eyed for fresh signals

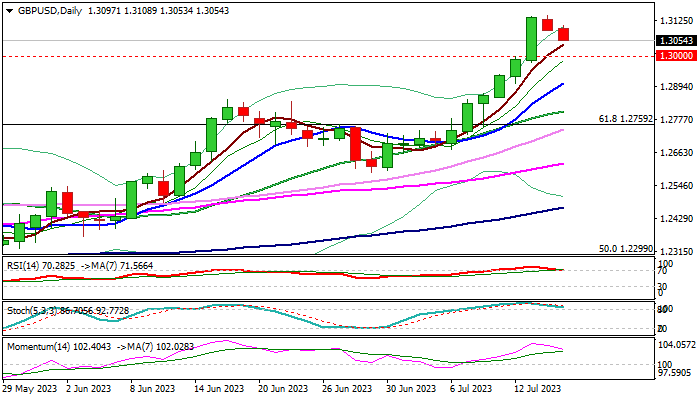

Pullback from new 2023 high (1.3141), where last week’s strong bullish acceleration was repeatedly rejected, extends into the second straight day.

Strongly overbought RSI /stochastic and fading bullish momentum on daily chart, contributed to decision to collect some profits.

Fresh bears face initial support at 1.30 (psychological), ahead of rising 10DMA (1.2906) and former top at 1.2848 (June 16), which should contain extended dips and keep larger bulls in play.

Markets shift focus on UK inflation report (due on Wednesday’s morning) which may provide more clues about BoE’s decision in Aug policy meeting.

British inflation is expected to ease in June (y/y 8.2% f/c vs 8.7% in May) with softer results to ease pressure on central bank, while above-forecast figures would add to expectations for 50 basis points hike.

Res: 1.3108; 1.3141; 1.3200; 1.3298

Sup: 1.3041; 1.3000; 1.2906; 1.2848