Cable falls to three week low on dovish steer in rate outlook / weaker than expected economic data

Cable remains firmly in red and accelerated lower on Thursday morning, falling over 1% for the session.

Sterling came under increased pressure from dovish comments from BoE Governor Bailey, who said the central bank could be more aggressive on rate cuts, adding to expectations for 25 basis points cut at the November 7 policy meeting.

Weaker than expected UK September Services PMI (52.4 vs 52.8 f/c and 53.7 Aug) contributed to pound’s bearish stance.

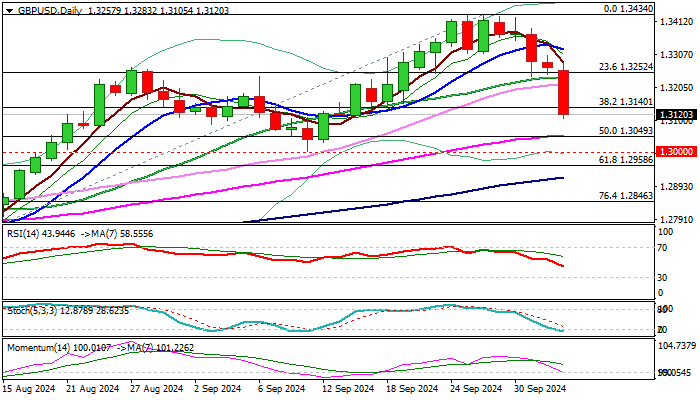

Fresh extension of bear-leg from 1.3434 (2024 high, posted on Sep 26) hit the lowest in three weeks, after break through pivotal Fibo support at 1.3140 (38.2% of1.2664/1.3434 rally) generated fresh bearish signal.

Weakening technical structure on daily chart (falling 14-d momentum cracks the centreline / 10/20 DMA’s above the price are converging and look to form a bear-cross) supports the notion.

Close below broken 1.3140 pivot to confirm signal and open way for attack at next targets at 1.3049/32 (50% retracement / 55DMA / daily cloud top) and 1.3000 (psychological / Sep 11 higher low / Fibo 38.2% of larger1.2299/1.3434 uptrend), with break of the latter to confirm reversal signal.

Res: 1.3140; 1.3200; 1.3217; 1.3252

Sup: 1.3100; 1.3032; 1.3000; 1.2958