US Elections 2024 Market Outlook: Potential Impact on Stocks, Commodities, Cryptocurrencies, and More

Key Takeaways

- The 2024 US Presidential Election is poised to significantly impact various markets, including stocks, commodities, cryptocurrencies, and the US dollar.

- A Trump victory could boost US stocks and cryptocurrencies but might lead to a weaker US dollar and volatile gold prices.

- A Harris victory may stabilize markets in the long term, benefiting sectors like renewables, but could initially cause market uncertainty and regulatory pressures on cryptocurrencies.

The 2024 US Presidential Election is set to be one of the most consequential in recent history, with potential ripple effects across global markets. In this article, we delve into the most likely outcomes of the 2024 Election along with their possible impacts on major financial markets including Stocks, Commodities, Cryptocurrencies, and the US Dollar.

The US Election Thus Far

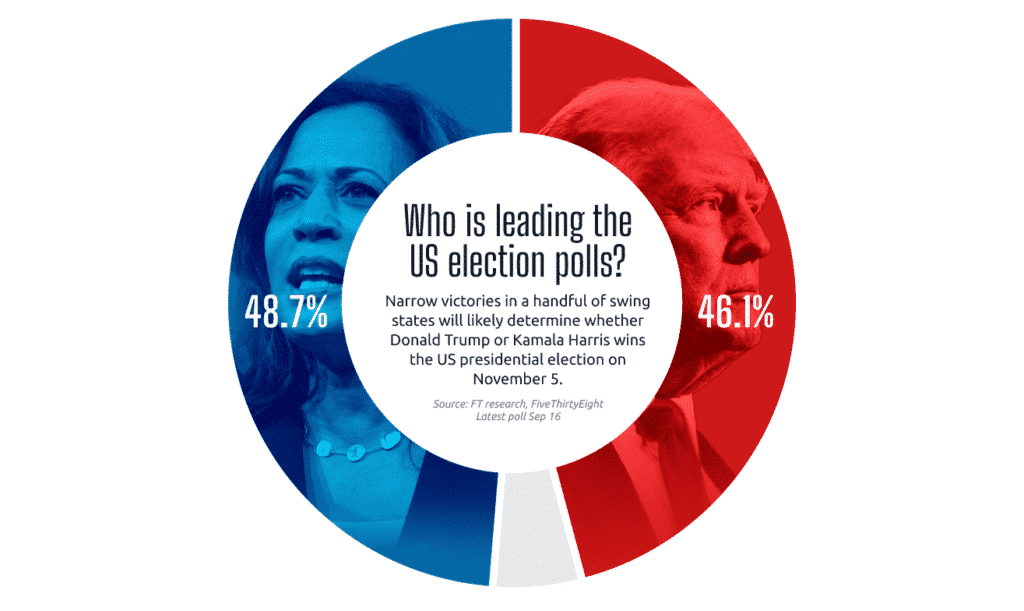

The 2024 election has been marked by intense debates, assassination attempts, and fluctuating polls. The debates have highlighted the stark differences between the candidates, while assassination attempts on Donald Trump have added a layer of uncertainty and tension. Polls have oscillated throughout the campaign, reflecting the tight race between Harris and Trump. Recent polls indicate a near-even split, with slight variations depending on the state and demographic surveyed.

A Look at the Most Probable Scenarios

The election outcome hinges on several key battleground states, making the 2024 US Presidential Election one of the most unpredictable in recent history. Current projections suggest a close contest, with potential for either candidate to secure a victory. Here are the three most probable scenarios:

Scenario 1: Trump Clean Sweep

In this scenario, Donald Trump wins the Presidency and the Republicans gain control of both the Senate and the House of Representatives. This outcome would likely lead to a significant shift in policy direction, with Trump having the legislative support to implement his agenda without major obstacles. Key policies could include further tax cuts, deregulation, and a strong stance on immigration. The markets might react positively to the prospect of reduced corporate taxes and deregulation, potentially boosting US stocks and major indices.

Scenario 2: Trump Constrained

Here, Donald Trump wins the Presidency, but Congress is split, with Democrats controlling the Senate and Republicans holding the House. This scenario would result in a more constrained presidency, with Trump facing significant legislative challenges. While he could still push for tax cuts and deregulation, passing major legislation would be more difficult. The markets might experience volatility due to the uncertainty and potential gridlock in Congress. However, Trump’s executive actions could still influence market dynamics, particularly in sectors like energy and finance.

Scenario 3: President Harris

In this scenario, Kamala Harris wins the Presidency, but Congress remains split, with Democrats controlling the Senate and Republicans holding the House. Harris would face significant challenges in passing her legislative agenda, which includes climate policies, social justice reforms, and increased regulation. The initial market reaction might be cautious, with potential flatlining of US stock markets due to concerns over tax increases and regulatory changes. However, sectors like renewables and clean energy could benefit from Harris’ policies, potentially leading to long-term stability and growth in these areas.

Harris vs. Trump: Two Vastly Different Agendas

Kamala Harris and Donald Trump offer contrasting visions for the U.S. Specifically, Harris prioritizes climate action, social justice, and regulatory reforms, aiming to address environmental and social inequalities. Her policies could drive investment in green technologies and socially responsible businesses. In contrast, Trump focuses on deregulation, tax cuts, and strict immigration policies, aiming to boost economic growth and protect national security. His approach may enhance corporate profits and market confidence but could raise concerns about sustainability and social equity. These differing agendas will significantly influence market expectations and investor sentiment.

What May Sway Voters

Key factors influencing voter decisions include economic performance, healthcare, immigration, and climate change. Additionally, recent events such as assassination attempts, the escalation of war in the Europe and the Middle East, as well as the latest debates have heightened voter engagement and could sway undecided voters

Projected Market Impact

US Indices & Stocks

- Trump Victory: A Trump win could significantly boost U.S. stocks and major indices. His administration’s policies, such as corporate tax cuts, deregulation, and efforts to lower lending rates, are designed to stimulate economic growth and increase corporate profitability. These measures could lead to higher stock prices and improved market performance. Sectors like energy, telecommunications, and utilities are likely to benefit the most from these policies. The energy sector could see increased investment and reduced regulatory burdens, while telecommunications and utilities might experience growth due to favorable regulatory changes and lower operational costs.

- Harris Victory: A Harris win may initially cause U.S. stock markets to flatline due to concerns over potential tax increases and increased regulations. Investors might be wary of higher corporate taxes and stricter regulatory measures, which could impact short-term profitability and market performance. However, over time, markets might welcome the stability and predictability that her administration could bring. Sectors like renewables and energy are likely to benefit significantly from her policies. Harris’s focus on climate action and sustainable energy could drive substantial investment into renewable energy projects, boosting growth and innovation in this sector. Additionally, companies involved in clean energy technologies and infrastructure development may see increased demand and favorable regulatory support, leading to long-term gains.

Cryptocurrencies

- Trump Presidency: Pro-crypto policies and deregulation under Trump could significantly boost cryptocurrency prices. By creating a more favorable regulatory environment, these policies would reduce barriers for crypto businesses and investors, encouraging broader adoption and innovation within the industry. This supportive stance could drive substantial price increases as confidence in the market grows. Additionally, the reduced regulatory burden might attract institutional investments, as large financial entities seek to capitalize on the potential for high returns in a more predictable and less restrictive environment. The influx of institutional capital could further stabilize and legitimize the cryptocurrency market, leading to sustained growth and increased mainstream acceptance.

- Harris Presidency: Under a Kamala Harris Presidency, regulatory pressures on major cryptocurrencies such as Bitcoin and Ethereum could have significant ripple effects across the broader cryptocurrency market. Harris’s administration might implement stricter regulations aimed at increasing transparency, preventing fraud, and protecting investors. These measures could include enhanced reporting requirements, tighter controls on exchanges, and more rigorous enforcement of existing laws. While these regulations could stabilize Bitcoin and Ethereum by making them more secure and trustworthy, they might also lead to steep declines in the altcoin markets. Altcoins, which often operate with less oversight and higher volatility, could struggle to comply with the new regulatory landscape. This increased scrutiny could result in reduced investor confidence and lower trading volumes for altcoins, causing their prices to drop sharply. Additionally, the focus on regulating major cryptocurrencies might divert attention and resources away from smaller, emerging projects, further exacerbating the challenges faced by altcoins.

Gold

- Trump Win: Under a Trump administration, gold might experience significant volatility. While his policies, such as tax cuts and business-friendly regulations, could boost stock markets and corporate profits, this economic optimism might lead to fluctuations in gold prices. Investors often turn to gold as a safe haven during times of uncertainty, and despite a potentially strong stock market, global uncertainties—such as geopolitical tensions, trade disputes, and economic instability in other regions—could still drive demand for gold. This dual influence means that while gold prices might dip as investors flock to equities, any resurgence in global risks or market corrections could quickly push gold prices higher.

- Harris Win: Under a Kamala Harris administration, gold prices are projected to rise due to several key factors. Anticipated government spending on infrastructure, social programs, and green initiatives could lead to increased fiscal stimulus, which might drive inflationary pressures. As inflation concerns grow, investors often turn to gold as a hedge against the eroding value of fiat currencies. Additionally, market volatility could be heightened by regulatory changes aimed at increasing transparency and accountability in financial markets. These regulatory shifts might create uncertainty, prompting investors to seek the stability and security that gold offers. Furthermore, global economic conditions and geopolitical tensions could exacerbate market fluctuations, further boosting demand for gold as a safe-haven asset.

US Dollar

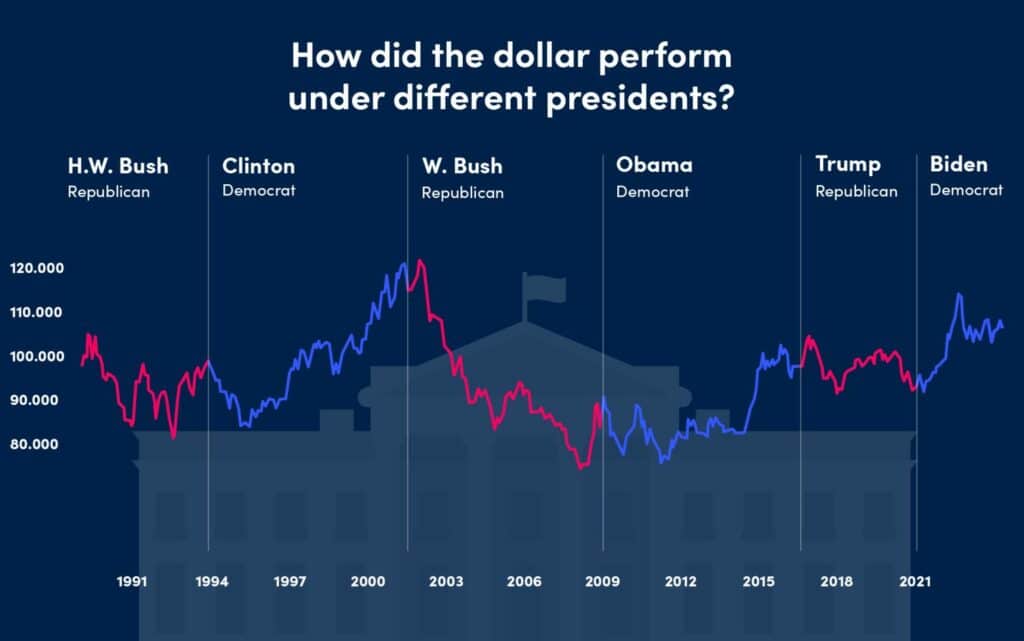

- Trump Victory: A Trump victory is projected to lead to a weakening of the US dollar due to several anticipated economic policies. His administration’s protectionist stance, characterized by policies aimed at shielding domestic industries from foreign competition, could lead to increased tariffs on imported goods. These tariffs might result in higher costs for consumers and businesses, potentially slowing economic growth and reducing the attractiveness of the US dollar. Additionally, Trump’s push for lower interest rates, intended to stimulate borrowing and investment, could further contribute to a weaker dollar. Lower interest rates typically reduce the returns on investments denominated in the currency, making it less appealing to foreign investors. The combination of protectionist policies, increased tariffs, and lower interest rates could create a challenging environment for the US dollar, leading to its depreciation in the global currency markets. This depreciation might have broader implications, affecting international trade balances and the purchasing power of American consumers.

- Harris Victory: A Harris victory could lead to a weakening of the US dollar due to several anticipated economic factors. Increased government spending on infrastructure, healthcare, and social programs is expected to raise the national debt, which might put downward pressure on the dollar. This fiscal expansion could lead to concerns about inflation, prompting investors to seek safer assets. Additionally, regulatory changes aimed at increasing oversight and accountability in various industries could create uncertainty in the markets. These changes might include stricter environmental regulations, financial reforms, and consumer protection measures, which could impact business operations and profitability. Market caution is likely to rise as investors assess the potential impacts of these policies, leading to reduced confidence in the US dollar. The combination of higher government spending, regulatory shifts, and increased market caution could contribute to a depreciation of the dollar in the global currency markets.

*Source: tradingview.com 01/20/1989 – 05/28/2024. Past performance is not indicative of future results.

Oil

- Trump Presidency: Under Trump, higher oil prices could result from a combination of stricter sanctions and geopolitical tensions. Stricter sanctions against countries like Iran, Russia, and Venezuela would likely reduce their oil exports, tightening global supply and driving up prices. These sanctions are part of Trump’s broader strategy to exert economic pressure on these nations, which could lead to significant disruptions in the global oil market. Additionally, increased uncertainty in the Middle East, a region already prone to conflict and instability, could further exacerbate supply concerns. Despite efforts to boost internal US oil production through deregulation and support for the fossil fuel industry, these measures might not be sufficient to offset the global supply constraints caused by sanctions and geopolitical risks. The combination of reduced foreign oil supply and heightened regional tensions could lead to sustained higher oil prices, impacting everything from transportation costs to inflation rates.

- Harris Presidency: Under a Kamala Harris presidency, crude and Brent oil prices may experience a decline due to several anticipated factors. Her administration’s strong focus on climate policies is likely to prioritize the transition to renewable energy sources, reducing reliance on fossil fuels. This shift could lead to decreased demand for oil, exerting downward pressure on prices. Additionally, regulatory changes aimed at curbing carbon emissions and promoting environmental sustainability could impose stricter standards on the oil industry. These regulations might include limits on drilling activities, higher environmental compliance costs, and incentives for clean energy alternatives. As oil companies face increased compliance costs and operational restrictions, their production capabilities and profitability could be adversely affected. Furthermore, the market might anticipate these changes and adjust accordingly, leading to a reduction in oil prices.

The Bottom Line

The 2024 US Presidential Election stands as one of the most contentious and closely watched in recent history. November 5, 2024, will mark a historic day with profound implications for global markets. Investors should prepare for heightened volatility and stay vigilant about policy changes that could affect their portfolios. Whether dealing with stocks, commodities, or cryptocurrencies, the election outcome will significantly influence market dynamics in the years ahead.

Stay Ahead of the US Elections with WB

At Windsor Brokers, we are committed to empowering traders with the knowledge and tools they need to navigate the complexities of the 2024 US Presidential Election. Our comprehensive US Elections Educational Campaign is designed to help you prepare for various election outcomes and capitalize on emerging market opportunities. Join us for our election-focused live sessions, upcoming webinars, and access our expert resources to stay informed and make well-informed trading decisions. Discover more about how you can stay ahead of the curve with Windsor Brokers