Crude prices extend gains on escalation of the Middle East crisis

Oil price extends strong rise into second consecutive day, advancing 1.6% during European session on Wednesday, following 3.45% advance on Tuesday (the biggest daily gain since Aug 12).

Growing fears that further escalation of the war in the Middle East could disrupt crude supply from the region, lifted oil prices significantly during past two sessions.

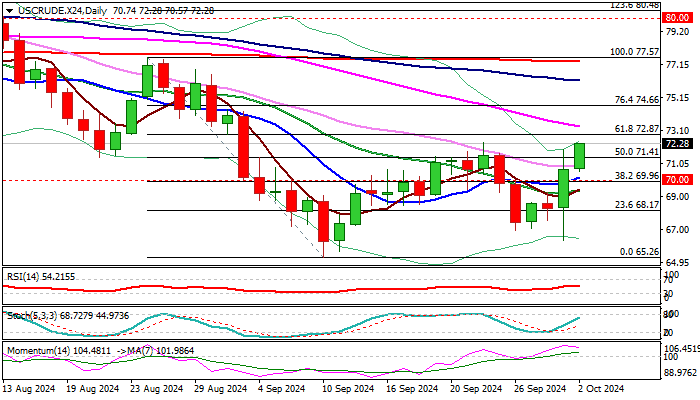

The latest rally improved the structure on daily chart, as the price rose above 50% retracement of $77.57/$65.26 bear-leg and psychological $70 level, underpinned by strong positive momentum and 10/20DMA’s in bullish configuration.

Bulls pressure pivotal resistance at $72.38 (Sep 24 lower top), break of which to generate fresh bullish signal on completion of bullish failure swing pattern on daily chart and soften strong bearish structure on weekly chart (multiple MA Death crosses / strong negative momentum).

Broken daily Kijun-sen ($71.08) should ideally contain dips and maintain bullish bias.

Caution on breach of $70 level (reinforced by 10DMA), which reverted to solid support and marks a breakpoint.

Fundamentals, however, are likely to play a key role in coming days, with further conflict escalation to provide fresh boost to oil price and open way for stronger upside acceleration.

Res: 72.38; 72.87; 73.37; 74.27

Sup: 71.41; 70.88; 70.00; 69.26