Increased safe-haven demand lifts dollar

The dollar remains firm versus the basket of major currencies early Wednesday, boosted by safe-haven demand following the latest escalation in the Middle East.

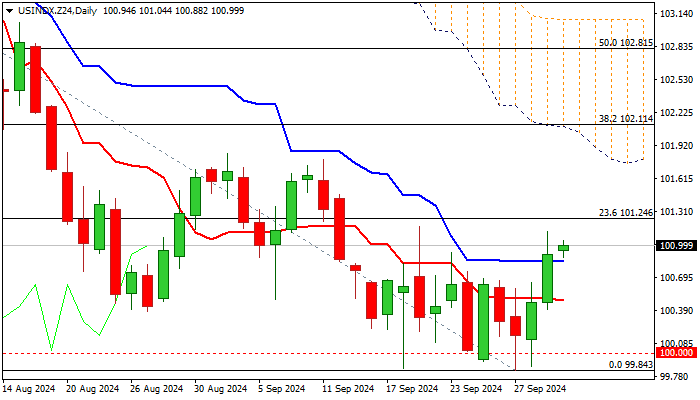

Two day bounce from strong 100 support zone, hit two-week high and pressuring pivotal barriers at 101.17/24 (consolidation range top / Fibo 23.6% of 105.78/99.84 downtrend), break of which to generate initial reversal signal and open way for stronger recovery.

Break higher to expose targets at 101.80 zone (lower platform) and more significant resistances at 102.11 (base of falling and thickening daily Ichimoku cloud / Fibo 38.2% of 105.78/99.84).

Improving technical picture on daily chart (break above daily Tenkan / Kijun-sen which turned sideways / 14-d momentum emerging into positive territory) supports the notion, along with formation of base at 100 zone and a bear-trap pattern.

Repeated close above daily Kijun-sen (100.84) will be required to maintain bullish bias.

From the fundamental side, growing geopolitical tensions are likely to continue to fuel dollar’s safe-haven appeal, with US labor report for September and non-manufacturing PMI also to be closely watched in coming sessions

Res: 101.24; 101.84; 102.11; 102.81

Sup: 100.84; 100.48; 100.00; 99.84