Cable lacks direction on Monday but thick daily cloud weighs

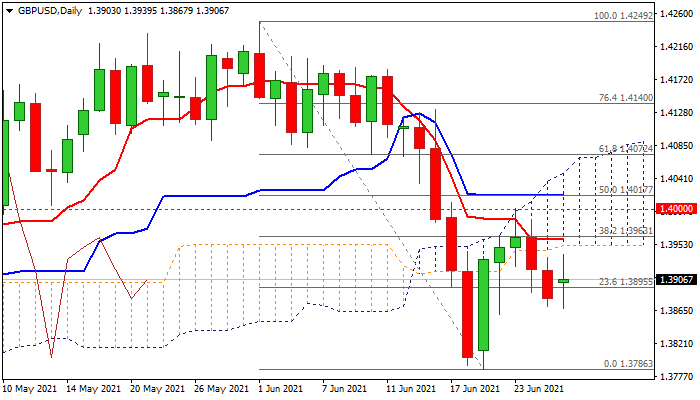

Monday’s Doji candle signals directionless near-term action after last week’s recovery was capped by psychological 1.40 barrier and subsequent weakness found footstep at 1.3868 (Fibo 61.8% of 1.3786/1.4001 upleg).

Rising and thickening daily cloud above the price maintains strong pressure and adds to negative signals from bearish momentum studies and moving averages in negative setup.

Near-term bias is expected to remain with bears as long as the price stays below cloud base (1.3951) and psychological 1.40 resistance, with risk of retesting last week’s low at 1.3786 (21 June), violation of which would open way for extension towards Mar/pr higher base at 1.3670 zone.

Traders await more signals from US June jobs data and scheduled lift of Covid restrictions (postponed to July 19).

Res: 1.3951; 1.3986; 1.4000; 1.4038

Sup: 1.3868; 1.3837; 1.3800; 1.3786