Aussie extends weakness on new lockdowns, iron ore losses

The Australian dollar holds in red for the second straight day and extends weakness after last week’s recovery was strongly rejected on Friday.

The Aussie is pressured by falling iron ore prices, Australia’s biggest export earner, and new lockdowns on outbreak of coronavirus delta variant.

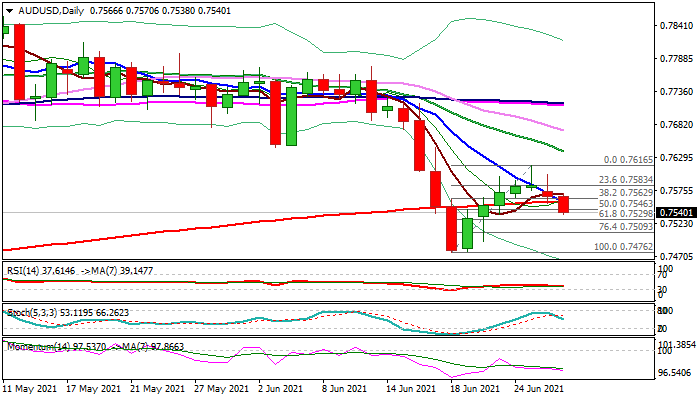

Last Friday’s shooting star candle signaled stall of recovery leg from 0.7476 (June 18 low) while subsequent acceleration lower added to reversal signal.

Fresh extension o Tuesday broke below 200DMA (0.7558), with daily close below here to further weaken near-term structure and risk deeper fall.

Daily techs maintain strong bearish momentum while moving averages returned to bearish configuration, as falling 10DMA is about to form a death-cross with 200DMA and boost negative signals.

Bears eye pivotal Fibo support at 0.7529 (61.8% of 0.7476/0.7616 upleg), loss of which would confirm reversal and open way towards key supports at 0.7476 (June 18 low) and 0.7445 (top of thick ascending weekly cloud) where bears could faces strong headwinds.

Res: 0.7558; 0.7570; 0.7601; 0.7616

Sup: 0.7529; 0.7509; 0.7476; 0.7445