Near-term action sees risk of further weakness

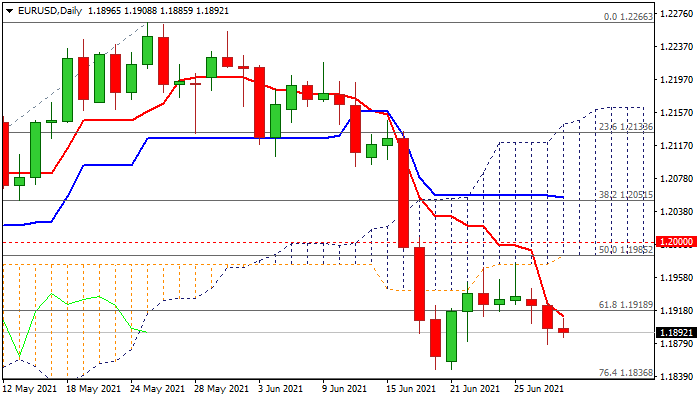

Last week’s strong upside rejection at the base of thick daily cloud (1.1974) and subsequent drop, warn of further weakness.

Near-term action is weighed by bearish daily studies and a massive cloud, keeping in play risk of attacking pivotal supports at 1.1847/36 (June 18/21 lows / Fibo 76.4% of 1.1704/1.2266 upleg).

Larger picture shows the action well supported by rising and thickening weekly cloud, which contained the action of past two weeks and providing headwinds to near-term bears.

Clearer direction signals could be expected on break of either pivotal points – 1.1836 at the downside and 1.20 zone at the upside.

Friday’s release of US June labor report is expected to give more clues about the pair’s direction.

Res: 1.1911; 1.1944; 1.1985; 1.2000

Sup: 1.1847; 1.1836; 1.1795; 1.1737