Cable regained traction after Friday’s nearly 1% fall; BoE eyed for fresh signals

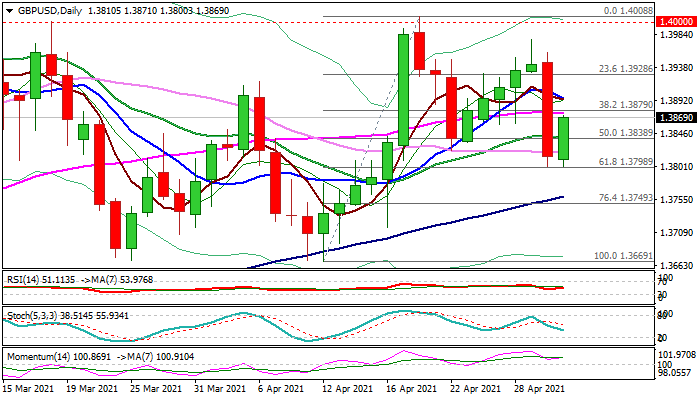

Cable bounces from two-week low (1.3800) posted after last Friday’s strong bearish acceleration that resulted in daily drop of daily drop of 0.94% (the biggest one-day loss in 2021).

Fresh strength in holiday-thinned market is partially attracted by this week’s daily cloud twist reduces immediate downside risk downside risk, although Friday’s massive bearish candle weighs.

Daily techs lack clearer signals as moving averages are in mixed mode, 14-d momentum is ascending, stochastic is heading south, while RSI is in sideways mode in the neutral territory.

Traders focus on BoE’s policy meeting this week which could generate fresh signals, as UK’s positive growth outlook and successful vaccine rollout suggest possible change in the policy.

The pound would appreciate on hawkish tones and signals for bond-buying reduction, while dovish stance looks more likely as Brexit headwinds continue to hit the economy, damaged by coronavirus pandemic and unchanged policy settings would increase pressure on sterling.

Res: 1.3875; 1.3928; 1.3958; 1.3976

Sup: 1.3800; 1.3759; 1.3715; 1.3670