Cable surges after upbeat UK PMI data

Cable jumped over one full figure and ticked above 1.21 mark on Tuesday, following upbeat Feb UK PMI data.

Report from UK economy’s dominant services sector showed PMI jumping to 53.3 in February (the highest since July) from 48.7 previous month and strongly beating 49.2 forecast.

Composite PMI which tracks the activity in both, services and manufacturing sectors and provides more details about the health of the economy, rose to 53.0 in February from 48.5 in January and well above 49.0 consensus.

Both indicators establish above 50 threshold which divides growth from contraction, generating positive signals.

Manufacturing PMI also made a significant gains (Feb 49.2 vs Jan 47.0 and 47.5 f/c), although remains below 50 level.

Much better than expected PMI reports boost optimism about the economy’s performance in the first quarter and also contribute to Bank of England’s hawkish shift in interest rate expectations.

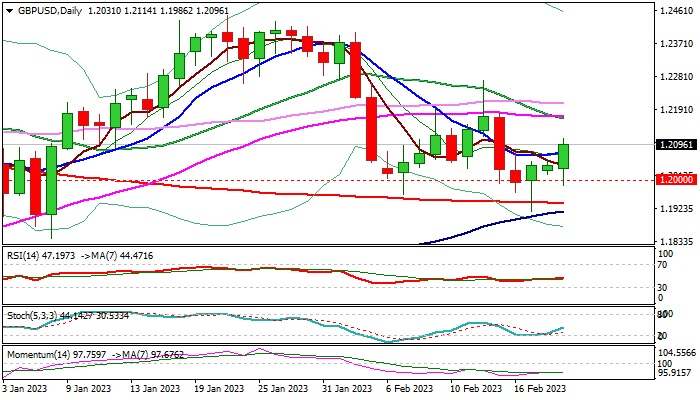

Technical picture on daily chart is improving after larger bears repeatedly failed to register clear break below psychological 1.20 support, as today’s bullish acceleration added to signal of bear-trap under 200DMA (1.1935).

Fresh rally probed above the top of daily Ichimoku cloud (1.2107), with close above the cloud (also near 50% retracement of 1.2269/1.1914 bear-leg) to firm near-term structure and add to reversal signals, opening way for further recovery.

Also, daily 100 and 200 moving averages are converging and on track to form a bull-cross, which would additionally support the action and contribute to positive signals from north-heading RSI and stochastic.

However, 14-d momentum indicator is still in negative territory that partially offsets bullish signals.

The near-term price action needs to hold above 1.2050, which is the minimum requirement to keep bullish bias, however, repeated failure to clear pivotal 1.2100 zone would signal weakening and keep the downside vulnerable.

Loss of 1.2050 support would risk renewed probe through 1.20 level and 200DMA.

Res: 1.2114; 1.2134; 1.2185; 1.2200

Sup: 1.2075; 1.2050; 1.2000; 1.1935