Consolidation above new 3-wk low eyes UK data for fresh signals

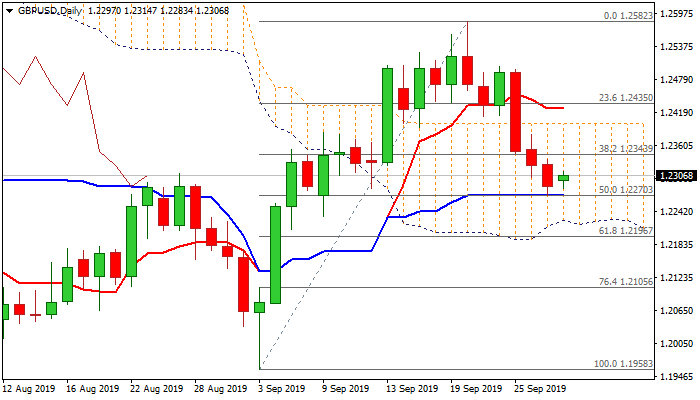

Cable ticks above 1.2300 handle in early Monday’s trading, as bears are taking a breather above new three-week low at 1.2270, where daily Kijun-sen / 50% of 1.1958/1.2582) provided footstep.

Negative sentiment was further soured by comments from BoE policymaker on Friday, who signaled rate cut, with consolidation on oversold conditions expected to precede fresh weakness.

Solid resistances at 1.2340 zone (Friday’s high / broken Fibo 38.2% of 1.1958/1.2582) should ideally cap, with stronger upticks to stay below daily cloud top (1.2399) to keep bears in play.

Break of 1.2270 pivot would open way for test of key supports at 1.2218/1.2196 (daily cloud base / Fibo 61.8% of 1.1958/1.2582).

UK GDP ( Q2 1.2% f/c vs 1.2% prev y/y) and current account (Q2 -19.5B f/c vs -30B prev) are key events for sterling today and could provide stronger signals on surprise on any side.

Res: 1.2314; 1.2343; 1.2368; 1.2390

Sup: 1.2270; 1.2233; 1.2218; 1.2196