Narrowing range ahead of RBA

The Australian dollar extends sideways mode into third straight day, awaiting tomorrow’s RBA policy meeting for fresh signals.

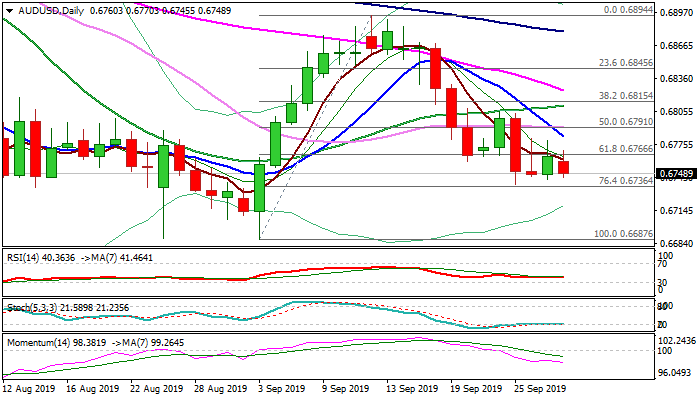

Bear-leg from 0.6894 (12 Sep high) is taking a breather above pivotal support at 0.6736 (Fibo 76.4% of 0.6687/0.6894) with daily MA’s in bearish setup, negative momentum and thickening daily cloud above, keeping bias with bears.

The RBA is widely expected to cut interest rates by 25 basis points to 0.75%, with focus on post-meeting statement.

The Aussie would come under increased pressure if the central bank cut rate and signals further easing, but dovish stance on signal of no further cuts until the end of the year, may sideline bears and push Aussie higher.

Falling 10DMA (0.6783) marks initial resistance and guarding pivots at 0.6807/11 (daily cloud base / 20DMA).

Res: 0.6766; 0.6783; 0.6811; 0.6825

Sup: 0.6736; 0.6700; 0.6687; 0.6677