Continuation of EU/UK trade talks is key event for sterling today

Cable remains constructive in early Tuesday’s trading, following positive close on Monday, although with daily candle with long upper shadow that points to upside rejection.

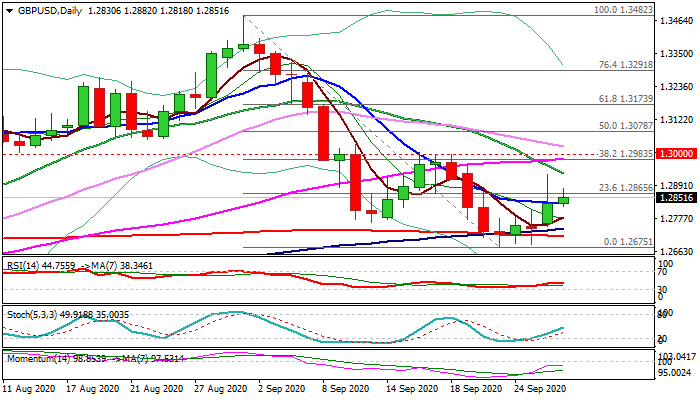

Fresh recovery that emerged after bear-trap under 200DMA, cracked initial barrier at 1.2865 (Fibo 23.6% of 1.3482/1.2675), but is lacking momentum that keeps in play risk of stall.

Recovery needs close above 10 DMA (1.2830) and Fibo 23.6% barrier (1.2865) for initial bullish signal, but confirmation of reversal would require extension above pivotal barriers at 1.2983/1.3000 (Fibo 38.2% of 1.3482/1.2675 / psychological).

Conversely, repeated failure to register daily close above 10DMA would keep the downside vulnerable and risk fresh attack at key 1.2759/04 support zone (base of rising daily cloud / 200DMA / Fibo 38.2% of 1.1446/1.3482), loss of which would open way for deeper correction of Mar/Aug 1.1446/1.3482 rally.

EU- UK trade talks resume in Brussels today and sterling is expected to be highly volatile on related headlines.

Although recent talks stalled on some important points, both sides showed optimism and kept upbeat Brexit rhetoric, but real breakthrough in negotiations would provide stronger direction signal for pound.

Res: 1.2882; 1.2934; 1.2983; 1.3000

Sup: 1.2818; 1.2780; 1.2759; 1.2716