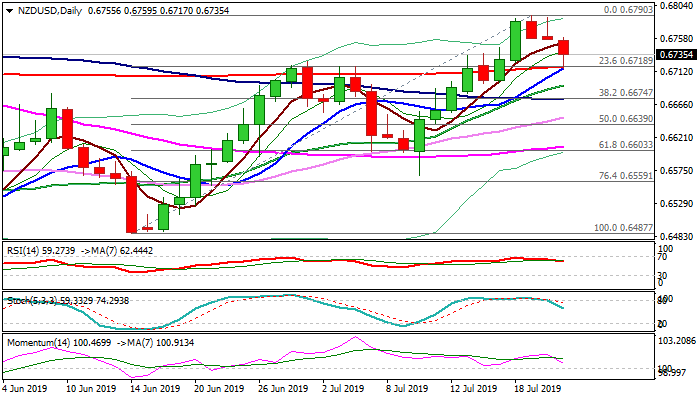

Converged 200/10DMA’s contain post-RBNZ bearish acceleration

The Kiwi dollar is consolidating above one-week low at 0.6717, posted today on fresh bearish acceleration of pullback from 0.6790 (19 July recovery high), triggered by comments from RBNZ, which announced an update of its unconventional policy strategy, earlier today.

Fresh weakness found footstep at 200DMA (also rising 10DMA, which is on track to form golden cross and reinforce this strong support).

South-heading daily indicators warn of deeper pullback on break below converged 200/10DMA’s, however, larger bulls from 0.6487 (14 June low) are expected to remain intact while the price stays above next key support at 0.6674 (Fibo 38.2% of 0.6487/0.6790 / 100DMA).

Res: 0.6759; 0.6790; 0.6830; 0.6872

Sup: 0.6717; 0.6692; 0.6674; 0.6648